Picture this: You’re about to apply for your dream home, but you’re worried about those pesky inquiries on your credit report. You’ve heard that they can drag down your credit score and hinder your chances of getting approved for a mortgage.

As a credit repair specialist, I’ve seen this scenario play out countless times. But here’s the good news – you have the power to remove hard inquiries and boost your credit score in just 24 hours.

In this ultimate guide, I’ll walk you through a detailed, step-by-step plan to remove inquiries in 24 hours. Whether you’re an entrepreneur looking to secure funding for your business or an individual striving for financial freedom, this guide will empower you to take control of your credit health.

The Science Behind Hard Inquiries

Before diving into the steps, it’s essential to grasp what hard inquiries are and their effect on your credit score. These occur when lenders assess your creditworthiness for credit cards, loans, or mortgages.

A single hard inquiry may slightly lower your score, but multiple ones in a short span can be detrimental. They signal potential financial distress to lenders, likely leading to higher interest rates or rejected applications.

However, not all inquiries are harmful. Soft inquiries, like pre-approved offers or your own credit report checks, don’t affect your score. It’s the hard inquiries that demand attention.

Step 1: Review Your Credit Report for Unauthorized Inquiries

The first step in removing hard inquiries fast is to get a clear picture of your credit landscape. You’re entitled to one free credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion every 12 months. Visit AnnualCreditReport.com to claim yours.

Once you have your reports in hand, put on your detective hat and scrutinize them for any unauthorized or unfamiliar inquiries. These could be inquiries you didn’t initiate or ones that you don’t recognize. Highlight these entries, as they’ll be the focus of your dispute efforts.

Common Examples of Unauthorized Inquiries

- Identity Theft: If someone has stolen your personal information and applied for credit in your name, you may see inquiries you didn’t authorize.

- Creditor Errors: Sometimes, creditors make mistakes and pull your credit report without a valid reason or confuse you with someone else.

- Prescreen offers: If you didn’t opt-out of prescreen credit offers, you may see inquiries from lenders you’ve never contacted.

Step 2: Dispute Unauthorized Inquiries with the Credit Bureaus

Now that you’ve identified the unauthorized inquiries, it’s time to take action and remove inquiries in 24 hours. Your weapon of choice? The dispute process.

You can dispute unauthorized inquiries directly with the credit bureaus online, by phone, or via mail. While all three methods can be effective, I recommend using certified mail with return receipt requested. This provides a paper trail and proof of delivery, which can be valuable if you need to escalate your case.

Here’s a step-by-step breakdown of the dispute process:

- Gather Evidence: Collect any documentation that supports your claim, such as proof that you didn’t authorize the inquiry or that the creditor made an error. This could include emails, letters, or screenshots.

- Draft a Dispute Letter: Clearly identify the inquiries you’re disputing and explain why they’re unauthorized. Use a professional and factual tone, and include copies of your supporting evidence. Get Guide to Factual Dispute Letter: 5 Steps to Get Results

- Submit Your Dispute: Send your dispute letter and evidence to the credit bureau via certified mail with return receipt requested. This ensures that you have proof of delivery and a timeline for their response.

- Wait For a Response: The credit bureau has 30 days to investigate your dispute and provide a response. However, many bureaus prioritize disputes and can remove inquiries in 24 hours, especially for straightforward cases.

If the credit bureau finds that the inquiry is indeed unauthorized, they’ll remove it from your credit report and notify the other bureaus to do the same. You’ll receive a copy of your updated credit report reflecting the removal.

Step 3: Follow Up with the Creditors

While disputing with the credit bureaus is often sufficient to remove hard inquiries, you can also contact the creditors directly for added assurance. This is particularly effective if you have a relationship with the creditor or if the inquiry was made in error.

When reaching out to creditors, use a polite but firm approach. Explain your situation and request that they remove the unauthorized inquiry as a gesture of goodwill. Some creditors may be more receptive if you’re a loyal customer or if the inquiry was made by mistake.

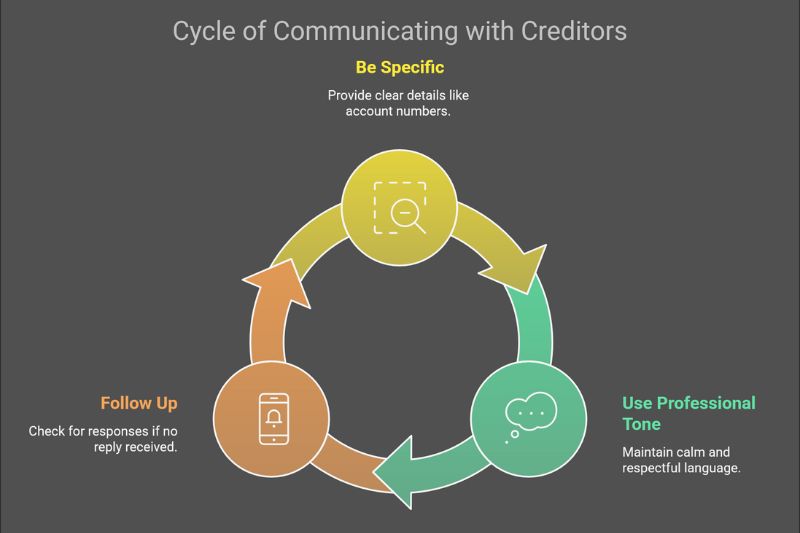

Here are a few tips for communicating with creditors:

- Be Specific: Clearly identify the inquiry you’re referencing and provide any relevant account numbers or dates.

- Use a Professional Tone: While it’s okay to express frustration, avoid using aggressive or accusatory language. Remember, you’re more likely to get a positive response if you remain calm and respectful.

- Follow Up: If you don’t receive a response within a week, follow up with a phone call or email. Persistence can pay off, but don’t cross the line into harassment.

Step 4: Consider Legal Action for Stubborn Inquiries

In rare cases, you may encounter a creditor or credit bureau that refuses to remove an unauthorized inquiry, even after multiple disputes and requests. If you find yourself in this situation, you may need to consider legal action.

The Fair Credit Reporting Act (FCRA) is a federal law that protects consumers’ rights when it comes to credit reporting. Under the FCRA, you have the right to dispute inaccurate or incomplete information on your credit report, including unauthorized inquiries.

Step 5: Monitor Your Credit Moving Forward

Additionally, be proactive about your credit habits moving forward:

While it’s okay to shop around for the best rates and terms, avoid applying for multiple accounts in a short period. Each application generates a hard inquiry, which can add up and impact your credit score.

Payment history is the most significant factor in your credit score, so make sure to pay all your bills on time, every time. Set up automatic payments or reminders to stay on track.

Your credit utilization ratio (the amount of credit you’re using compared to your credit limits) is another key factor in your credit score. Aim to keep your utilization below 30%, and even lower if possible.

Regularly review your credit reports. Even after you’ve removed unauthorized inquiries, it’s essential to review your credit reports regularly for errors or signs of identity theft. Mark your calendar to request your free reports every 12 months.

By adopting these healthy credit habits, you can build and maintain a strong credit profile that opens doors to better opportunities and financial success.

FAQs

Can I dispute inquiries online?

Yes, all three major credit bureaus (Equifax, Experian, and TransUnion) allow you to dispute inquiries online through their respective websites. However, it’s still a good idea to follow up with a written dispute letter for your records.

How long do inquiries stay on my credit report?

Hard inquiries typically remain on your credit report for up to two years. However, they only impact your credit score for the first 12 months.

Can I remove legitimate inquiries that I authorized?

Removing legitimate inquiries is more challenging and not always possible. Creditors are not obligated to remove inquiries that you authorized, even if you later regret the decision. However, some creditors may be willing to remove the inquiry as a goodwill gesture if you have a strong relationship with them.

How many points will removing an inquiry boost my credit score?

The impact of removing an inquiry varies depending on your individual credit profile. Generally, a single inquiry removal may only boost your score by a few points. However, removing multiple inquiries can have a more significant impact, especially if you have a shorter credit history.

What if I've been a victim of identity theft?

If you suspect that unauthorized inquiries on your credit report are the result of identity theft, take immediate action to protect yourself:

- Place a fraud alert on your credit reports

- Contact the creditors associated with the unauthorized inquiries

- File a police report and an identity theft report with the FTC

- Consider placing a credit freeze to prevent further fraudulent activity

Remember, recovering from identity theft can be a lengthy process, but staying vigilant and taking swift action can minimize the damage to your credit and financial well-being.

Conclusion

In this ultimate guide, we’ve explored the ins and outs of removing hard inquiries from your credit report in just 24 hours. By disputing unauthorized inquiries, communicating with creditors, and monitoring your credit moving forward, you can take control of your financial destiny.

Remember, your credit health is a journey, not a destination. By staying proactive and adopting healthy credit habits, you can build and maintain a strong credit profile that opens doors to better opportunities and financial success.

So what are you waiting for? Put these secret ways to remove hard inquiries into action and start repairing your credit today. Your dream credit score is within reach you just have to claim it.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.