It is crucial to your future that you take care of your credit. A credit score can effect you in all facets of life. For many employers, they will pull your credit report to try and get an idea about what kind of person you are. You need a healthy credit score to buy a car, home or send the kids to college in many cases. If you have run into an issue on your credit report, you need to know how to write a credit report dispute letter. It is a good idea to closely monitor your credit report on a monthly basis. This will allow you to quickly identify and remove any misinformation before it can cause you issues when applying for credit

What is a Dispute Letter?

The dispute letter is the first step that must be taken to have inaccurate information removed from a credit report. It provides a paper trail and is evidence of your attempt to work with the credit reporting agency and the reporting creditor to have the information removed. The letter is your best chance at getting someone to do something about the misinformation. Phone calls are not enough. You need a paper trail.

There are various reasons behind the information finding its way on to your credit report. It could be a case of mixed up files, the creditor applying your payment to another account, identify theft or a social security number that has been typed into a system incorrectly.

Most of the major credit reporting bureaus have online portals that allow you to submit your dispute online. This is a quick and easy method that many people opt for in this day and age. The steps to writing the dispute letter are the same as they would be for a standard letter sent through the mail. The only difference is your return receipt will be electronic and your response will be via email.

How Do I Create a Credit Report Dispute Letter?

Fortunately, the process is fairly easy. You can buy software that includes an easy-to-use template or make your own on your home computer. The following 10 steps will guide you in creating a letter that will help you get your credit back on track so you can do everything you want in life.

1. Identify The Mistakes

Make sure the information is truly inaccurate. Do some research on your own to make sure the information is not correct. If someone in your family has access to your accounts, check with them. If you suspect identity theft, you will need to file a police report and begin the process of cleaning up your credit.

2. Make A Copy

Make a copy or several to send to all three of the major credit reporting bureaus. You want to provide the proof of the mistake. Highlight the item that you are disputing. This makes it easy for the bureau to identify and begin the process of removing the misinformation.

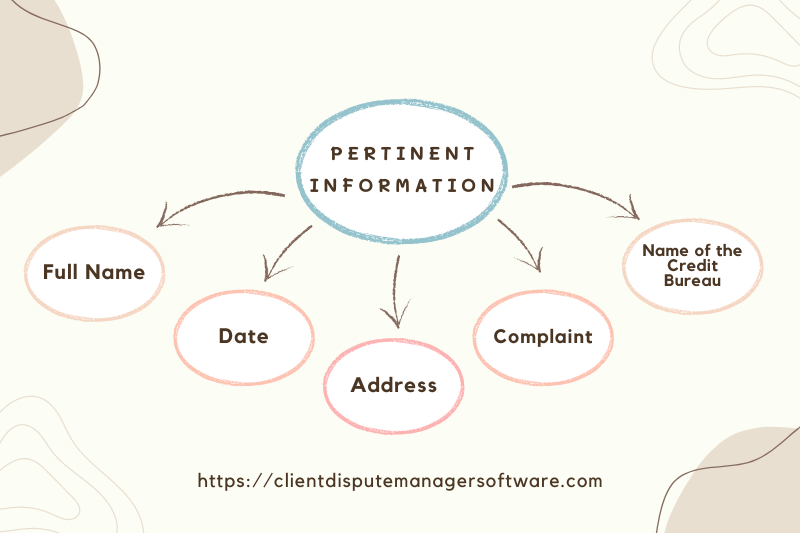

3. Begin The Letter with Pertinent Information.

- Full name

- Date

- Address

- Complaint Department

- Name of the Credit Bureau

- Their address

4. Get to The Point in The Opening Paragraph of Your Letter.

You will want to state you are disputing an item on your credit report and keep it simple. Avoid lengthy explanations about why it isn’t accurate. Do not quote laws or make threats to sue the agency. It isn’t helpful to your cause.

5. Briefly Explain The Item and The Facts

Keep it short and sweet and to the point. The person reading the letter has to process it, along with plenty of others. You don’t want your credit report dispute letter to be so lengthy, it automatically gets put to the side. This is not the time to present a mountain of evidence in your favor.

6. A Closing Paragraph That Outlines The Documentation

A Closing paragraph that outlines the documentation you are providing should wrap up the letter. If you have several documents, briefly explain the importance of each document and how it proves your claim the information is not accurate. This is the part of the letter that reiterates your request to have the information removed from the credit report.

7. Enclose Copies Of Any Documentation That supports Your Request

A copy of the credit report with the line items highlighted and/or circled, receipt if the payment was actually made or any other proof you can provide that proves you are not responsible for the item on the credit report. If you are a victim of identity theft, a copy of the police report and the report number will be necessary.

8. Mail The Letter Certified With A Return Receipt

It is best to mail the letter certified with a return receipt requested. This will provide you with proof the letter was received as well as the day the letter was received. It will also start the clock ticking on an appropriate response time.

9. Wait 30 Days Before Take Additional Steps

Do not call the credit bureau and hound the employees. Your credit report dispute letter is meant to speak for you. It ensures you are staying within the boundaries of the law and not letting your emotions run away from you in a heated conversation.

10. Credit Bureau's Response

The credit bureau will respond to your dispute via a letter in the U.S. mail after about 30 days. If there is no response or the action taken by the credit bureau is unsatisfactory, you will need to escalate your dispute.

Conclusion

Writing your own letter to credit bureaus is something you can definitely do. However, some people are hesitant to take on such an important task themselves and prefer to hire professionals to take care of the duty. You can certainly write your own credit report dispute letter with these 10 easy steps or look into hiring a company to take care of all of it for you.