If you’re trying to improve your credit score or have unsatisfactory credit standing, you’ve probably heard of a 609 letter. Of course, no one likes having a bad credit score. If you have a recent negative statement or debt that caused your credit score to decrease and is inaccurate, consider writing a 609 letter.

A 609 letter requests credit bureaus to abolish any erroneous negative statements on your credit report. The name 609 is derived from section 609 of the FCRA or Fair Credit Reporting Act. It is a federal law that protects every consumer from unfair collection practices and credit.

What is a 609 letter?

A 609 letter is typically written to the three major nationwide credit bureaus: TransUnion, Equifax, and Experian. This letter allows a consumer to dispute any false credit claims.

A 609 letter is a written request to credit agencies to verify unsubstantiated or erroneous items on a credit report. The letter is under the FCRA, which regulates credit reporting agencies.

Does writing a 609 letter actually work?

It is a common method to dispute any error in your credit report. The caveat of this letter is that if the alleged information is incorrect, unverifiable, or questionable, the info will remain on your credit report.

It is important that before you write a 609 letter, you should be confident that the item is unverifiable or false. If the mistake on your credit report is verified as a mistake, it will most likely be removed.

Limitations of the 609 Letter

There are specific things that a 609 letter cannot do. The 609 letter is not a legal loophole that consumers can use anytime to remove any accurate information on their credit report.

The letter cannot relieve you of any verifiable debt. If the credit bureau successfully verifies your debt, it will surely remain on our credit report. Any existing debt would also be untouched and remain on your report.

Steps to Writing a 609 Letter

Before writing a 609 letter, you should request a credit report. A credit report will provide and show you any negative items on your report. Carefully check through your credit report to see any erroneous or falsified information.

A 609 letter is a legal document and not creative material. There’s no proprietary format in creating this letter, and no particular format is better than another. You can write a 609 letter on your own, provided that you provide accurate and verifiable information.

Let us help you write that letter! Read on below and follow these steps.

Step 1: Request your credit report

An important step before writing a 609 letter is a credit report. Review your credit report and check for any mistakes or erroneous information. Make sure that all debts are true and accurate.

Step 2: Writing your 609 letter

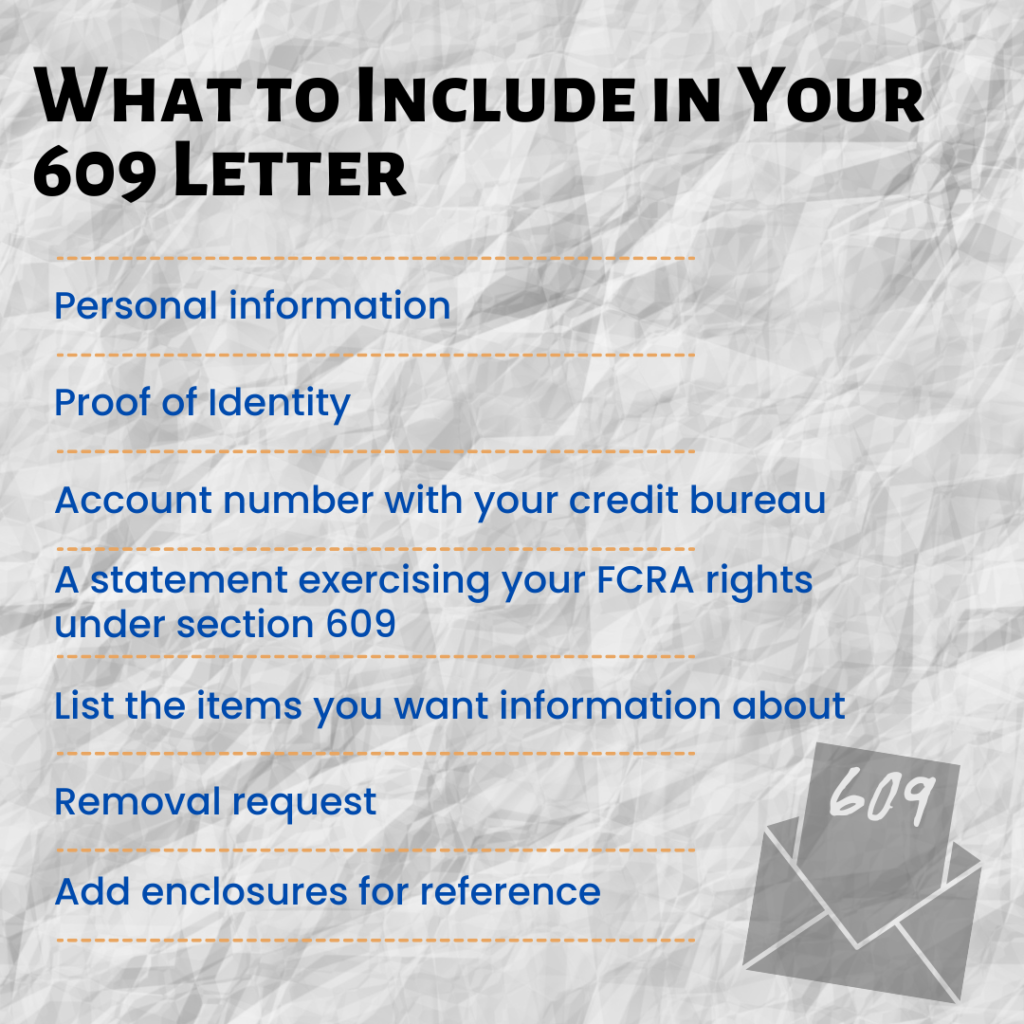

After checking your report and finding that there are erroneous items, you can now create a 609 letter to dispute any false items. Include the following information below in your 609 letters.

- Personal information: Your full name, address, date of birth, and contact details should be in the letter.

- Proof of Identity: Include a copy of a government ID like your passport, driver’s license, or Social Security number.

- Account number with your credit bureau: the account number should match the credit report you want to dispute.

- Credit report: Include your most recent and verified credit report. Highlight any erroneous item on your credit report.

- A statement exercising your FCRA rights under section 609: State that you are entitled to any information related to each item. You should include the contract containing your signature and original credit application.

- List the items you want information about: Include the items along with the date you want to dispute. If your credit report has many false items, you can encircle them instead of listing them. It makes it easier for the receiver of the letter to find the items. Refer to the disputed items in your 609 letter.

- Removal request: Besides requesting the information about the false items in your credit report, include a statement that if they cannot verify an item by finding sufficient documents or evidence for that claim, they should withdraw that erroneous item within thirty days.

- Add enclosures for reference: Enclosures are additional documents along with the 609 letter. At the bottom of your 609 letter, include ‘Enclosures,” which references all the documents you submit to the bureau.

Step 3: Mail your completed letter to the three major nationwide credit bureaus.

Send your 609 letter to the three major national credit bureaus. When you mail it, request a return receipt from the postal service.

The postal service will give you a return receipt once the mail is successfully delivered. The return receipt is important as it provides evidence that the credit bureaus have received your 609 letter.

Below are the addresses of the major credit bureaus:

EXPERIAN:

PO Box 4500

Allen, TX 75013

EQUIFAX Information Services, LLC:

PO Box 740256

Atlanta, GA 30374-0256

TRANSUNION Consumer Solutions:

PO Box 2000

Chester, PA 19016-2000

After following the steps above, you should now feel confident in writing that 609 letter. Disputing statements can be worrisome if you are not prepared. If your inaccurate negative information is verified and not yet removed within thirty to forty-five days from the date you received confirmation, it’s suggested to write another dispute letter.

The credit bureau should respond to your letter. If they don’t respond after sending them follow-up letters, you can report them to the FTC or Federal Trade Commission. The FTC is a federal agency responsible for enforcing the Federal Credit Reporting Act.

If you file a complaint with the FTC, the credit bureau will be pressured to respond to your letter and fix any false items on your report much faster. Remember that 609 letters are not legal loopholes and must be used carefully. It is a simple but effective way to assert your rights under the FCRA.

Bonus: Now that you have read the article on writing a 609 letter, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that. Click here to learn more.