Are you tired of seeing that bankruptcy on your credit report, holding you back from achieving your financial goals? Do you feel like you’ve paid your dues and are ready to move forward, but your credit score just won’t budge? Fear not, because in this article, we’ll walk you through a detailed, step-by-step plan on how to remove bankruptcy from your credit report legally. We’ll also address some frequently asked questions to help you better understand the process and take control of your financial future.

Understanding The Impact of Bankruptcy on Your Credit

Before we dive into the nitty-gritty of removing bankruptcy from your credit report, let’s take a moment to understand how bankruptcy affects your credit in the first place. When you file for bankruptcy, it’s like a big red flag on your credit report, signaling to lenders and creditors that you’ve had some serious financial difficulties in the past. This can make it harder to obtain credit, secure loans, or even land certain jobs.

But not all bankruptcies are created equal in the eyes of the credit reporting agencies. Chapter 7 bankruptcies, which involve the liquidation of assets to pay off debts, tend to stick around on your credit report for a full 10 years. Chapter 13 bankruptcies, on the other hand, which involve a repayment plan over several years, typically fall off your report after just 7 years from the filing date.

The Long-Term Effects of Bankruptcy

While bankruptcy can provide a fresh start and relief from overwhelming debt, it’s important to recognize the long-term consequences it can have on your financial life. Some potential effects of bankruptcy include:

- Difficulty Obtaining Credit: With a bankruptcy on your credit report, lenders may view you as a high-risk borrower and be hesitant to extend credit.

- Higher Interest Rates: Even if you are able to secure credit after bankruptcy, you may face higher interest rates due to your perceived risk as a borrower.

- Challenges Renting or Buying A Home: Landlords and mortgage lenders often consider credit history when evaluating applications, and a bankruptcy can make it more difficult to qualify.

- Employment Challenges: Some employers, particularly those in the financial sector or positions requiring security clearances, may conduct credit checks as part of the hiring process. A bankruptcy could potentially impact your job prospects.

It’s crucial to understand these potential consequences and weigh them against the benefits of bankruptcy when considering your options for dealing with overwhelming debt.

Step 1: Get Your Hands on Your Credit Reports

The first step in your mission to remove bankruptcy from your credit report is to get a clear picture of where you stand. You’ll want to obtain copies of your credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. Thanks to the Fair Credit Reporting Act (FCRA), you’re entitled to one free credit report from each bureau every 12 months. You can request them easily at AnnualCreditReport.com

Why Reviewing Your Credit Reports Is Crucial?

Reviewing your credit reports regularly is essential for several reasons:

- Identifying Errors Or Inaccuracies: Mistakes happen, and sometimes bankruptcy information can be reported incorrectly on your credit reports. By reviewing your reports, you can spot these errors and take steps to have them corrected.

- Monitoring For Fraudulent Activity: Regularly checking your credit reports can help you identify any suspicious activity or accounts opened in your name without your knowledge, which could be signs of identity theft.

- Tracking Your Progress: As you work to rebuild your credit after bankruptcy, reviewing your credit reports allows you to see the impact of your efforts and make adjustments to your strategy if needed.

Step 2: Scour Your Credit Reports for Errors

Once you have your credit reports in hand, it’s time to put on your detective hat and comb through them for any errors or inaccuracies related to your bankruptcy. Here are some common issues to look for:

- Incorrect Bankruptcy Filing Date: Make sure the date reported matches the actual date you filed for bankruptcy.

- Wrong Bankruptcy Chapter: Verify that the correct chapter (7 or 13) is listed on your reports.

- Accounts Included in Bankruptcy That Shouldn’t Be: Double-check that only the accounts included in your bankruptcy are reported as such. Accounts that were not part of the bankruptcy filing should not be labeled as included in bankruptcy.

- Multiple Bankruptcy Listings: Sometimes, a single bankruptcy filing may be listed multiple times on your credit reports, which can make your credit situation look worse than it actually is.

If you spot any errors, gather supporting documentation, such as court orders or bankruptcy discharge papers, to help substantiate your dispute.

Step 3: File Disputes with the Credit Bureaus

Now that you’ve identified any inaccurate bankruptcy information on your credit reports, it’s time to take action and file disputes with the credit bureaus. You can typically dispute errors online, by mail, or by phone. When filing your dispute, make sure to provide:

- Your full name and contact information

- The specific item you are disputing

- A clear explanation of why the information is inaccurate

- Supporting documentation to back up your claim

Under the FCRA, credit bureaus have 30 days to investigate your dispute and provide a response. If they determine that the disputed information is indeed inaccurate, they are required to remove it from your credit report.

Tips for Filing Effective Disputes

To increase your chances of a successful dispute, keep these tips in mind:

- Be Specific And Concise: Clearly identify the error you are disputing and provide a straightforward explanation of why it is inaccurate.

- Provide Supporting Evidence: Include copies of any relevant documents that support your dispute, such as court orders or bankruptcy discharge papers.

- Keep Records: Maintain a copy of your dispute letter and any supporting documentation for your records. Also, consider sending disputes by certified mail with a return receipt requested to have proof of delivery.

- Follow Up: If you don’t hear back from the credit bureaus within the 30-day investigation window, follow up to ensure they received your dispute and are working on resolving the issue.

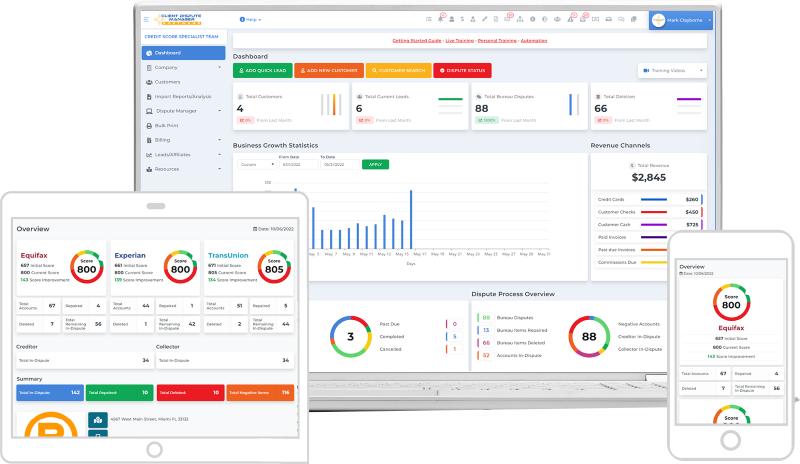

Streamlining the Dispute Process with Client Dispute Manager Software

As you work to remove inaccurate bankruptcy information from your credit reports, keeping track of your disputes and communications with credit bureaus can be challenging. This is where Client Dispute Manager Software comes in handy.

Client Dispute Manager Software is designed to help individuals and credit repair professionals efficiently manage the dispute process. These tools often provide features such as:

- Organizing and tracking dispute letters and responses

- Generating customizable dispute letter templates

- Automating follow-up reminders and notifications

- Securely storing relevant documentation and evidence

- Providing real-time status updates on dispute progress

By utilizing Client Dispute Manager Software, you can streamline your efforts to remove inaccurate bankruptcy information from your credit reports. These tools help ensure that you stay organized, meet important deadlines, and have all the necessary documentation readily available.

Step 4: Stay Persistent and Seek Legal Help if Needed

If the credit bureaus do not respond to your dispute within the required timeframe or if the inaccurate bankruptcy information remains on your credit report after the investigation, don’t give up. You may need to escalate your dispute by filing a complaint with the Consumer Financial Protection Bureau (CFPB) or your state’s Attorney General’s office.

In some cases, you may want to consider seeking the assistance of a consumer protection attorney who specializes in credit reporting issues. They can help you navigate the dispute process and take legal action if necessary to ensure your rights under the FCRA are being upheld.

Frequently Asked Questions (FAQs)

Can I Remove A Bankruptcy From My Credit Report Myself?

If the bankruptcy information on your credit report is inaccurate or outdated, you can file a dispute with the credit bureaus to have it removed. However, if the information is accurate and current, you generally cannot remove it yourself before it naturally falls off your report after 7-10 years, depending on the type of bankruptcy.

How Long Does A Chapter 7 Bankruptcy Stay On Your Credit Report Compared To A Chapter 13?

Chapter 7 bankruptcies typically remain on your credit report for 10 years from the filing date, while Chapter 13 bankruptcies stay on your report for 7 years from the filing date.

Will My Credit Score Automatically Improve After Removing Bankruptcy From My Credit Report?

Removing inaccurate or outdated bankruptcy information from your credit report can potentially improve your credit score, as it eliminates negative information that may be dragging down your score. However, the impact on your score will depend on various factors, such as the rest of your credit history and any other negative items that may be present. Rebuilding your credit takes time and consistent positive financial behaviors.

Can I Still Qualify For Loans Or Credit Cards With A Bankruptcy On My Credit Report?

While a bankruptcy on your credit report can make it more challenging to qualify for loans or credit cards, it’s not impossible. Some lenders specialize in working with individuals with past credit issues, including bankruptcies. As time passes and you demonstrate responsible credit management, your chances of qualifying for credit will generally improve.

How Can I Find Reputable Resources To Help Me Navigate The Credit Repair Process After Bankruptcy?

There are several trusted resources available to help you navigate credit repair after bankruptcy:

- Non-profit Credit Counseling Agencies: These organizations provide free or low-cost credit counseling and can help you develop a plan to rebuild your credit. Look for agencies accredited by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

- Federal Trade Commission (FTC): The FTC offers a wealth of information on credit repair, debt management, and consumer rights on their website, consumer.ftc.gov.

- Consumer Financial Protection Bureau (CFPB): The CFPB provides educational resources and tools to help consumers understand and manage their credit, as well as a complaint process for issues with credit reporting agencies or lenders. Visit consumerfinance.gov for more information.

When seeking credit repair assistance, be wary of companies that promise to remove accurate negative information from your credit report or charge upfront fees for their services, as these are often red flags for credit repair scams.

Conclusion

Removing bankruptcy from your credit report legally requires persistence, attention to detail, and a commitment to rebuilding your credit over time. By obtaining your credit reports, identifying and disputing errors, and implementing positive credit habits, you can work towards improving your financial standing and achieving your goals.

Remember, everyone’s financial journey is unique, and overcoming the challenges of bankruptcy is possible with the right mindset and strategies. Stay focused on your goals, seek help when needed, and celebrate your progress along the way.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.