Are you thinking of starting a credit repair business in New York? If so, it’s important to know that the state has specific laws in place that govern how these businesses operate. In this article, we’ll explore the key laws you need to be aware of before launching your credit repair business.

Business Structure

Decide on the structure of your business (sole proprietorship, partnership, LLC, or corporation) and register it with the New York Department of State, Division of Corporations.

Sole Proprietorship:

This is the simplest form of business structure where the business is owned and operated by a single person. The owner is personally liable for the debts and obligations of the business.

Partnership:

A partnership is a business structure where two or more people share ownership of the business. Each partner is personally liable for the debts and obligations of the business.

Limited Liability Company (LLC):

An LLC is a popular business structure for small businesses because it offers the protection of a corporation while maintaining the tax benefits of a partnership. Owners, known as members, are not personally liable for the debts and obligations of the business.

Corporation:

A corporation is a separate legal entity from its owners, known as shareholders. Corporations provide the greatest protection from personal liability for their owners but are subject to more regulatory requirements and taxation.

It is important to consult with a lawyer or accountant to determine the best business structure for your credit repair business, based on your specific circumstances and goals.

Federal EIN

Obtain a Federal Employer Identification Number (EIN) from the IRS. This is needed for tax purposes.

Determine If You Need an EIN:

An EIN is required if you have employees, operate as a partnership or corporation, plan to open a business bank account, or apply for certain licenses or permits. If you are a sole proprietor and do not have employees, you may not need an EIN, but it can still be useful for tax purposes.

Apply For an EIN:

You can apply for an EIN online through the IRS website, by fax, mail, or by phone. The online application process is the quickest and most efficient. You will need to provide information about your business, such as the legal name, address, and type of business entity.

Receive Your EIN:

Once your application is complete and approved, the IRS will issue you an EIN. You can use this number to open a business bank account, file tax returns, and apply for licenses and permits.

It is important to keep your EIN safe and secure, as it is used to identify your business for tax purposes. If you need to make changes to your EIN, such as changing your business structure or name, you will need to notify the IRS.

New York State Tax ID

Apply for a New York State Sales Tax ID through the New York State Department of Taxation and Finance. Visit the New York State Department of Taxation and Finance website.

Step #1: Visit Official Website

Step #2: Access The Online Application Portal

On the homepage, click on the “Business” tab, then select “Sales tax I am running a few minutes late; my previous meeting is running over. registering and other information.” On the next page, click on “Register for sales tax.”

Step #3: Create An Online Services Account

If you don’t have an Online Services account, click on “Create Account” to set one up. You’ll need to provide your personal information, including your Social Security Number, and create a username and password.

Step #4: Log In to Your Online Services Account

Once you have an account, log in using your credentials.

Step #5: Complete The Application

Click on “Apply for a Certificate of Authority” and follow the prompts to complete the application. You’ll need to provide information about your business, including its legal structure, location, and estimated sales tax liability.

Step #6: Submit The Application

After filling out the application, review it for accuracy and submit it electronically.

Step #7: Receive Your Certificate Of Authority

Upon approval, the New York State Department of Taxation and Finance will issue your Certificate of Authority. You should receive it within a few weeks of submitting your application.

Please note that the process and website may change over time, so make sure to check for the most up-to-date information on the New York State Department of Taxation and Finance website before applying.

Business Licenses and Permits

Check with your local city or county clerk’s office to determine if any additional licenses or permits are required for your business. Some of the licenses and permits that may be required include:

- Business License: A general business license is required to operate any business in New York. This license can be obtained from the city or county where the business is located.

- Sales Tax Permit: If your credit repair business makes sales of tangible personal property or certain services, you may be required to obtain a sales tax permit from the New York State Department of Taxation and Finance.

- Debt Collection License: If your credit repair business engages in debt collection activities, you may be required to obtain a license from the New York State Department of Financial Services.

- Home Improvement Contractor License: If your credit repair business offers home improvement services, you may be required to obtain a Home Improvement Contractor License from the New York City Department of Consumer Affairs.

It is important to research and comply with all licensing and permit requirements in New York for your credit repair business. Failure to do so can result in fines, penalties, and legal issues.

Credit Services Business Registration

Some states require CSO’s to register with one or more of the specific state agencies to know exactly who is practicing credit repair within their state.

No, New York does not currently require CSO registration. However, there may be other registration and/or licensing requirements. For more information, consult the New York Attorney General’s Office.

Surety Bond

Obtain a surety bond as required by the state of New York. The bond amount may vary, so check with the New York Attorney General’s Office for the most up-to-date requirements.

New York does not currently require a surety bond. However, you should consult with the New York Attorney General’s Office to obtain the most recent information.

Compliance with Federal Credit Repair Organizations Act (CROA)

Ensure that your business practices comply with CROA, a federal law that regulates credit repair organizations. This includes providing written contracts, not charging upfront fees, and offering a right to cancel to your clients.

The primary federal law that regulates credit repair in New York and across the United States is the Credit Repair Organizations Act (CROA), which is part of the Consumer Credit Protection Act (15 U.S.C. §§ 1679-1679j). The purpose of the CROA is to protect consumers from unfair and deceptive practices by credit repair organizations.

Some key provisions of the CROA include:

- Prohibited Practices: Credit repair organizations are prohibited from making false or misleading statements about their services, engaging in fraudulent or deceptive practices, or charging or receiving fees before services have been fully performed.

- Written Contracts: Credit repair organizations must provide a written contract to clients that includes the terms of the service, a detailed description of services to be provided, the time required to achieve results, and the total cost of services.

- Right to Cancel: Clients have the right to cancel a credit repair contract within three business days of signing the contract, without any penalty or obligation.

- Disclosures: Credit repair organizations are required to provide clients with a written disclosure statement that informs them of their rights under the CROA and other consumer credit protection laws, such as the Fair Credit Reporting Act (FCRA).

- Record Keeping: Credit repair organizations must maintain detailed records of their client’s transactions and correspondence for a period of two years after the date of the last transaction.

In addition to the CROA, credit repair organizations in New York must also adhere to other federal laws related to credit reporting and consumer protection, such as the Fair Credit Reporting Act (FCRA), the Fair Debt Collection Practices Act (FDCPA), and the Truth in Lending Act (TILA).

The N.Y. Gen. Bus. 28-BB § 458-a et seq. is a section of the New York General Business Law that pertains to credit services businesses. Specifically, Article 28-BB is known as the “Credit Services Business Act.” The purpose of this legislation is to regulate credit services businesses operating within New York State, providing consumer protection and establishing requirements for the operation of these businesses.

Here is an overview of key provisions of the Credit Services Business Act:

- § 458-a: Definitions This section defines key terms used in the legislation, including “credit services business,” “buyer,” “consumer reporting agency,” and “person.”

- § 458-b: Registration of credit services businesses This section outlines the registration requirements for credit services businesses operating in New York State. It stipulates that businesses must register with the New York State Department of State and renew their registration annually.

- § 458-c: Prohibited practices This section lists practices that are prohibited for credit services businesses, such as making false or misleading statements, engaging in fraudulent or deceptive practices, or charging or receiving fees before completing the contracted services.

- § 458-d: Written statement of buyer’s rights This section requires credit services businesses to provide buyers with a written statement of their rights under the Credit Services Business Act. The statement must be provided before the execution of any contract for services.

- § 458-e: Contract requirements This section outlines the requirements for contracts between credit services businesses and buyers. Contracts must be in writing, signed by both parties, and include specific terms and disclosures.

- § 458-f: Right to cancel contract This section grants buyers the right to cancel a contract with a credit services business within five business days of signing the contract, without any penalty or obligation.

- § 458-g: Violations and penalties This section establishes penalties for violations of the Credit Services Business Act, including civil penalties, injunctions, and criminal penalties for willful violations.

Professional Liability Insurance

Consider obtaining professional liability insurance to protect your business from potential legal claims.

Professional Liability Insurance, also known as Errors and Omissions (E&O) insurance, is a type of insurance coverage that provides protection for businesses and individuals against claims of negligence or mistakes in the services they provide.

For a credit repair business in New York, Professional Liability Insurance can protect against claims of errors or omissions in the credit repair process, such as incorrect credit reports or failure to provide services as promised.

In addition to Professional Liability Insurance, a credit repair business in New York may also need to consider other types of insurance coverage, such as:

- General Liability Insurance: This type of insurance provides protection against claims of bodily injury, property damage, and personal injury that may occur on your business premises or as a result of your business operations.

- Cyber Liability Insurance: With the increasing prevalence of cyber attacks and data breaches, Cyber Liability Insurance can protect your credit repair business against claims of cyber-related damages, such as theft of client data or damage to computer systems.

- Workers’ Compensation Insurance: If your credit repair business has employees, Workers’ Compensation Insurance is required in New York to provide coverage for medical expenses and lost wages in the event of a work-related injury or illness.

It is important to consult with an insurance professional to determine the types and amount of insurance coverage needed for your credit repair business in New York, based on the specific risks and liabilities associated with your business operations.

Develop a Comprehensive Business Plan

Create a detailed business plan outlining your marketing strategies, target market, competition analysis, pricing structure, and financial projections.

Developing a comprehensive business plan for a credit repair business in New York is an important step in starting and growing your business. A well-developed business plan can help you clarify your goals, identify potential challenges, and create a roadmap for success.

Here are some key elements to consider when developing a comprehensive business plan for your credit repair business in New York:

- Executive Summary: This section provides an overview of your business, including your mission statement, target market, and unique selling proposition.

- Market Analysis: This section outlines the competitive landscape of the credit repair industry in New York, including market size, trends, and key competitors.

- Service Offering: This section describes the services your credit repair business will offer, including credit report analysis, dispute resolution, and credit counseling.

- Marketing Strategy: This section outlines your plan for reaching your target market, including advertising, social media, and partnerships with other businesses.

- Operations Plan: This section details the day-to-day operations of your credit repair business, including staffing, technology, and workflow processes.

- Financial Projections: This section provides a detailed financial forecast for your business, including revenue projections, expenses, and cash flow.

- Risk Analysis: This section identifies potential risks and challenges that could impact your credit repair business in New York, such as regulatory changes or changes in consumer behavior.

It is important to continually review and update your business plan as your credit repair business grows and evolves. A well-developed business plan can help you stay focused and make informed decisions to achieve your goals.

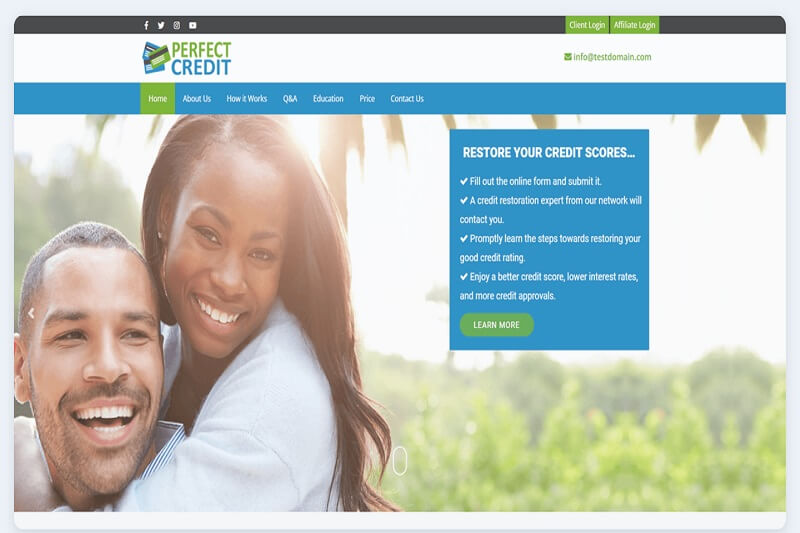

Establish a Web Presence

Create a website and utilize social media platforms to promote your services and engage with potential clients.

Here are some steps you can take to establish a web presence:

Create a Website:

Your website should provide information about your credit repair business, including services offered, pricing, and contact information. Your website should also be mobile-friendly and easy to navigate. Consider hiring a professional web developer to ensure your website is visually appealing and functional.

Utilize Social Media:

Social media platforms such as Facebook, Twitter, and LinkedIn can be powerful tools for promoting your credit repair business and engaging with potential clients. Create business profiles on these platforms and regularly post informative content related to credit repair and financial wellness.

Search Engine Optimization (SEO):

SEO is the process of optimizing your website to appear higher in search engine results. This can help drive traffic to your website and generate leads for your credit repair business. Consider hiring an SEO specialist to help you improve your website’s search engine ranking.

Online Directories:

Online directories such as Google My Business, Yelp, and Yellow Pages can help potential clients find your credit repair business. Ensure your business information is accurate and up-to-date on these directories.

Online Advertising

Consider utilizing online advertising platforms such as Google Ads and Facebook Ads to promote your credit repair business to potential clients in New York.

Establishing a strong web presence can take time and effort, but it can help your credit repair business reach a larger audience and grow your client base in New York.

Networking and Industry Knowledge

Join professional organizations, attend industry conferences, and stay up to date with changes in credit repair laws and best practices. Here are some ways to get networking and industry knowledge:

Join Industry Associations:

Joining industry associations such as the National Association of Credit Services Organizations (NACSO) can provide access to resources and networking opportunities with other professionals in the credit repair industry.

Attend Industry Events:

Attending industry events such as conferences and trade shows can provide opportunities to learn about the latest trends and developments in the credit repair industry and network with other professionals.

Utilize Social Media:

Social media platforms such as LinkedIn and Twitter can be valuable tools for networking with other professionals in the credit repair industry and staying up-to-date on industry news and trends.

Attend Local Business Events:

Attending local business events such as chamber of commerce meetings and networking events can provide opportunities to connect with other business owners and professionals in your local community.

Work with Industry Experts:

Consider partnering with industry experts such as attorneys or accountants who can provide valuable insights and advice on the credit repair industry.

Read Industry Publications:

Reading industry publications can provide insights and updates on the credit repair industry.

By utilizing these networking and industry knowledge strategies, you can expand your knowledge base and establish valuable connections within the credit repair industry in New York.

Ready to start your credit repair business in New York?

Make sure you are informed and compliant with the latest state laws.

Click now to learn more.

As you embark on your journey to start a credit repair business in New York, remember that compliance with state and federal laws is essential. By operating within the legal framework, you can establish a reputation for ethical and effective credit repair services.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.