This content is a transcript of the video above.

Mark Clayborne here, founder of clientdisputemanagersoftware.com; your coach, your mentor and your lead generation master. What’s up, everybody? How’s everybody out there today? Hey, I’m doing these videos every day. I want to teach you. I want to train you how to Stop Frivolous Letters.

What Is a Frivolous Letter?

What Information Should Be Available On This Letter?

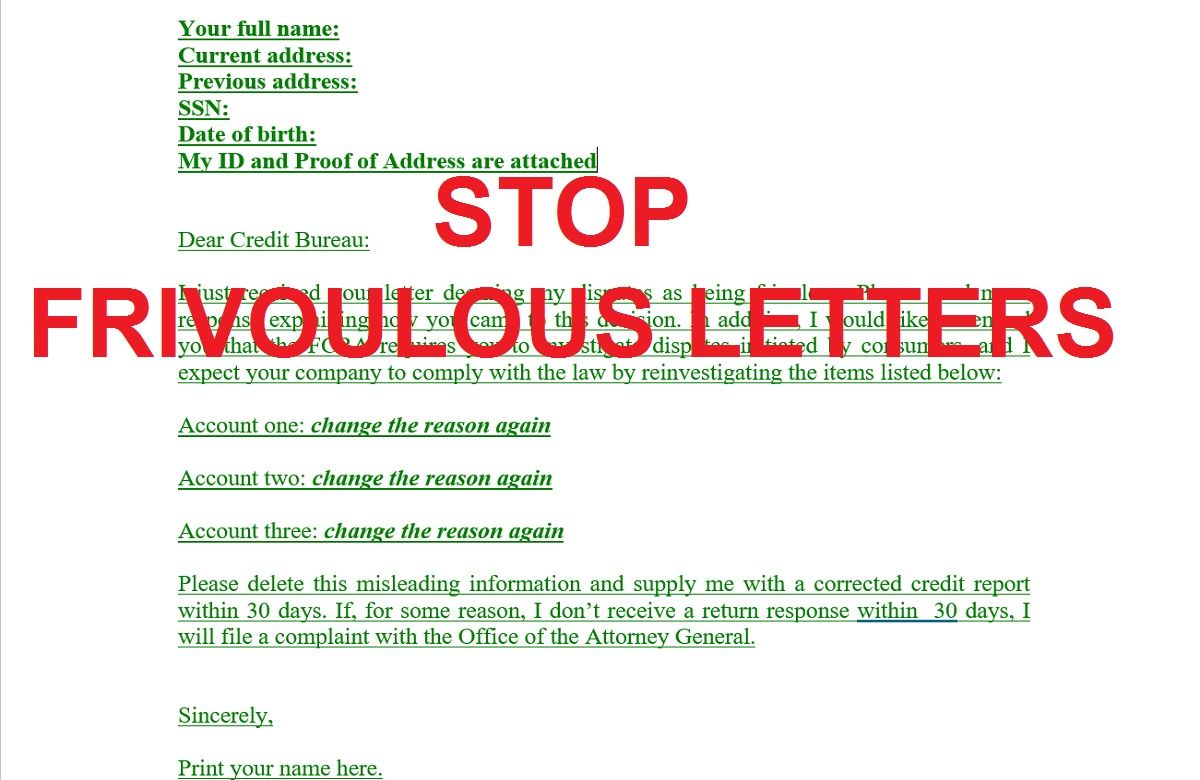

Alright, so as you know right here this is standard stuff right here. Your first name, your current address, your previous address, your social security number, date of birth, your ID and proof of address. You want to make sure that you attach a copy of your license and your social security card and your utility bill. Either for you or for your customer; whoever’s doing this credit repair. You want to make sure you do that, alright.

How does It work?

Now check this out. Dear, Credit Bureau, I just received your letter deeming my disputes as being frivolous. So you just tell the Credit Bureaus that hey, look I got your letter and you are saying that it’s frivolous. Well, how do they know that it’s frivolous? Are they in my house hmm?

I don’t know. What you’re going to do is you’re going to say; please send me a response explaining how you came to this decision. So the Credit Bureau is saying that the letters that you sent out are frivolous. So you’re asking them well how do you know this? So please send me a response explaining how you came to the decision that my letter that I sent to you is frivolous. Alright, let’s go. In addition ,

I would like to remind you that the Fair Credit Reporting Act requires you to investigate disputes initiated by consumers. You are the consumer, so you’re just reminding the Credit bureau of your rights and I expect your company to comply with the law by reinvestigating the items listed below.

So you are telling the Credit bureau that I expect you to do what you supposed to do and not sending these crazy letter stating that their frivolous right. And then you’re telling them which account; as you can see right here account one, all right. Then you’re giving them your dispute reason on why you feel that this account is not frivolous and also why you feel the account is inaccurate.

So you list your reasons here and then you tell the Credit bureau what to do. Please delete this misleading information and supply me with a corrected credit report within 30 days. You have to tell the Credit bureau what you want. If for some reason, I don’t receive a return response within 30 days I will file a complaint with the office of the Attorney General’s Office.

What To Do If You Don’t Receive Any Response?

So what you’re doing is you’re telling the Credit bureau that if they don’t continue to investigate or if you don’t receive some sort of response within 30 days you’re going to file a complaint with the attorney general’s office in your particular state and you can do that.

And when you file a complaint with the Attorney general’s office, the Attorney general’s office is going to reach out to the credit bureau and say hey, this consumer filed this complaint; what is going on? The great thing about that is that this letter works and it is to get the credit bureaus to respond.

So this is a good counter letter when they send you that crazy and stupid fruitless letter when in fact it’s not. You have every right as a credit repair company to represent a client if you have a power attorney. And you also have every right to dispute inaccurate information on your credit report if you are in fact a consumer trying to fix your own credit report, all right.

What To Include?

So what we’re going to do right now let’s go to amazon.com and we’re going to go right to amazon.com and I want to show you the number one credit repair book in the country. I want to type in credit repair. I’m not even going to type in hidden credit repair secrets; just credit repair and just going to click that.

It is still number one on amazon.com right here. It’s still number one right here. It’s going to click that; alright perfect. So as you can see ‘Hidden Credit Repair Secrets’ is still number one. You can get it on kindle, you can get it on paperback, you can get it on audio.

This is the book that you need. It has 261 reviews right here. It’s five-star, alright. Very powerful book. Get your training, start right here. This is Mark Clayborne; the best-selling author of the number one credit repair book in the country. I taught you a little bit about frivolous letters. Hey get yours, until then take care.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.