A credit bureau letter is a letter intended for the credit bureau to let them know you are disputing a negative item or information on the credit report as per your credit repair business plan because it is incorrect, outdated, etc.

There are three major nationwide credit bureaus in the U.S.: Equifax, Experian, and TransUnion. Credit bureaus are specific organizations that partner with all types of lending institutions and creditors to help them in their lending decisions.

They gather account details from companies you have financial accounts with third-party collection agencies and public records. All the information they’ve collected about you is combined into a credit report and sold to banks, financial institutions, insurance companies, and even you.

In their simplest form, credit bureaus are also known as credit reporting agencies.

If a borrower appears to be less creditworthy based on the credit bureaus report, they may be denied loans or charged a higher interest rate to compensate for the additional risk.

And as a credit repair service provider, if you find information on your customer’s credit report that you and your customer believe is inaccurate or incomplete, you may file a dispute with the credit bureau using the letters we have in the credit repair business plan.

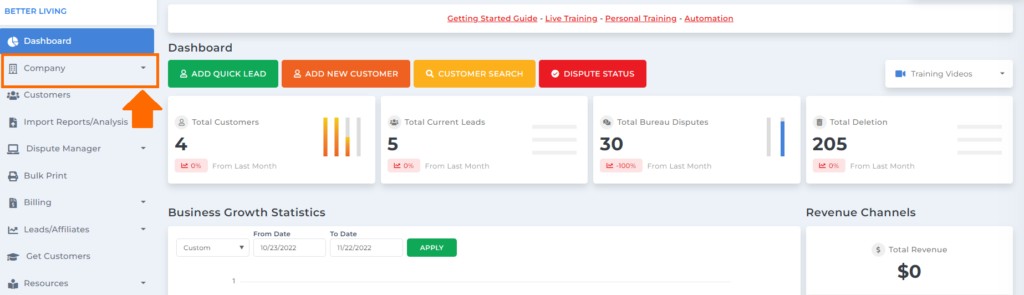

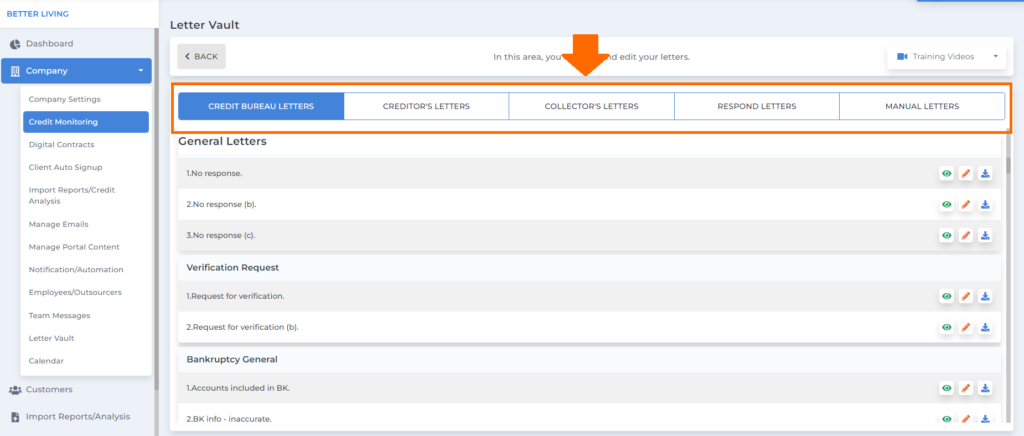

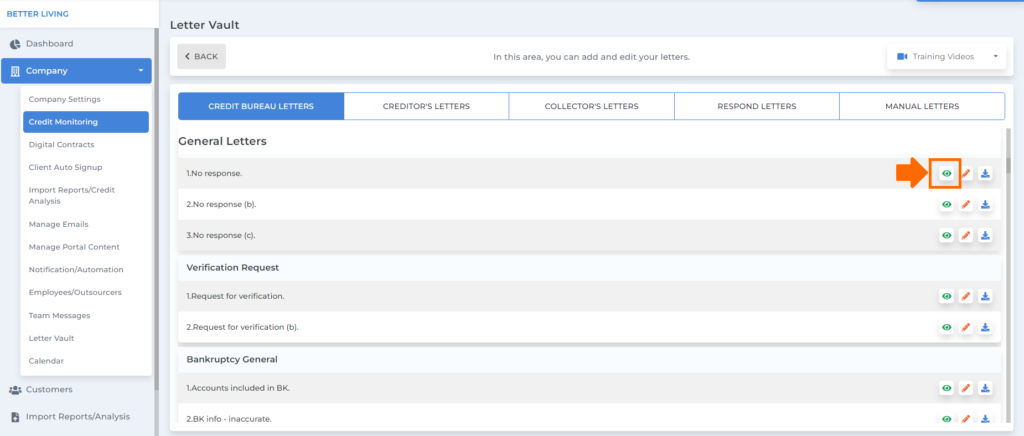

To check the credit bureau letters in the credit repair business plan, go to the company tab.

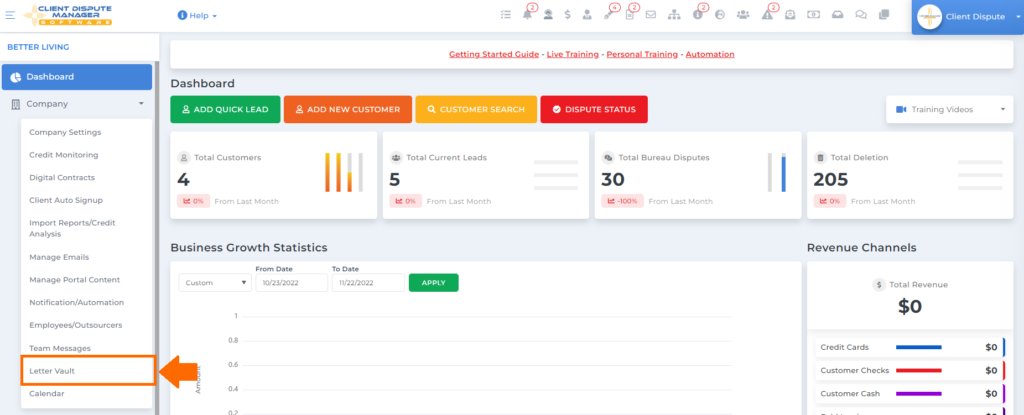

Then under the company menu options, click letter vault.

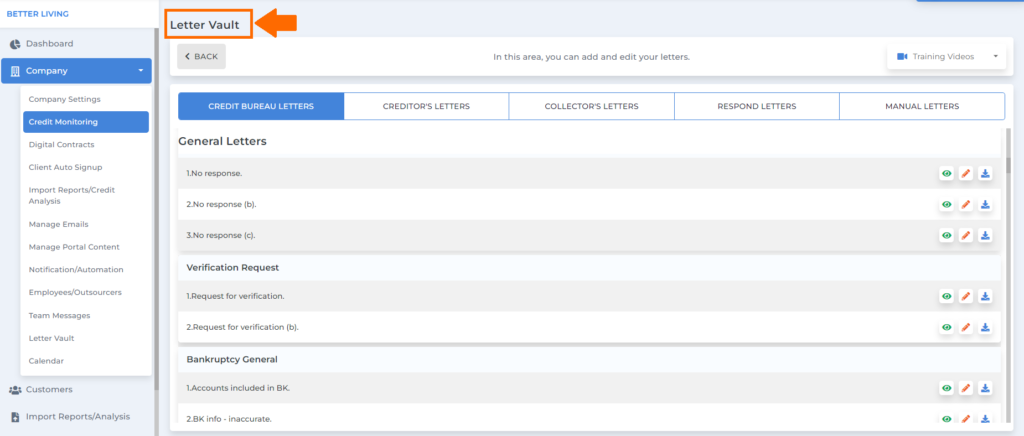

Once done, you will be routed to the letter vault screen, where you can see all the letters available to use. In this area, you can also add and edit your letters.

In the letter vault, we have letters for credit bureaus, creditors, collectors, respond, and manual letters.

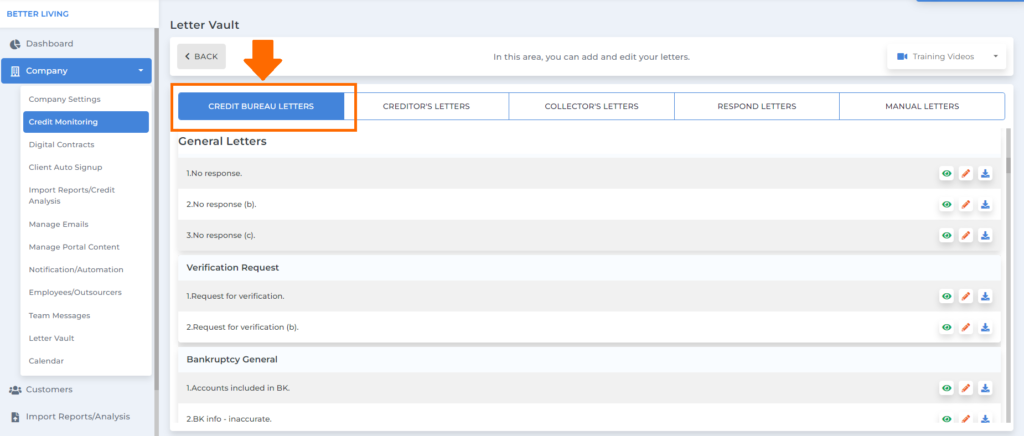

Over here are the credit bureaus letters available for you to use.

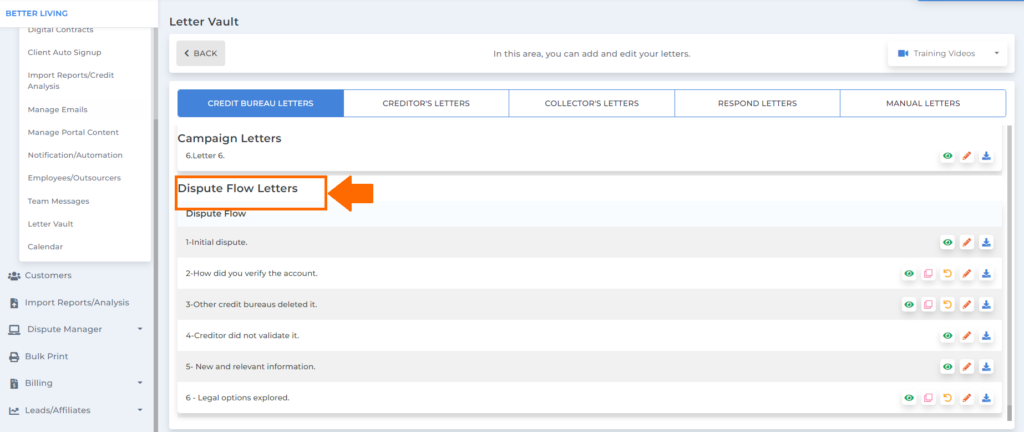

Under credit bureau letters, we have general, campaign, and dispute flow letters.

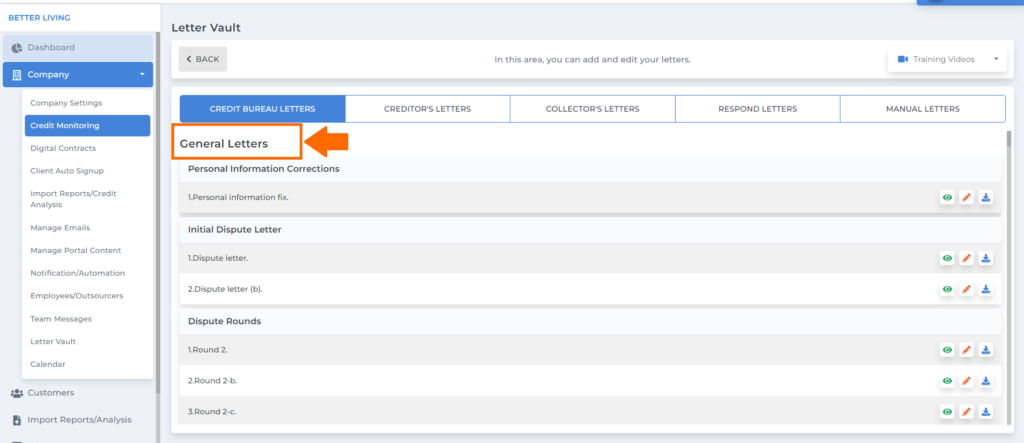

General Letters

– These letters are used to dispute or disagree with the errors in your credit report, like personal information fix, validation, and bankruptcy, to name a few.

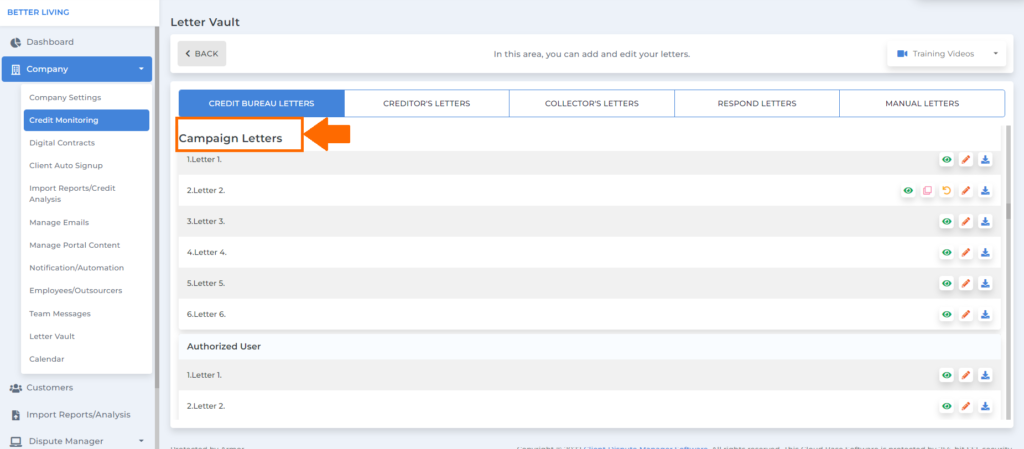

Campaign Letters

– These letters are more aggressive compared to other letters because they target derogatory accounts. And they do not follow a certain flow.

Dispute Flow Letters

– These letters are in general, and they follow a certain flow. It’s a series of dispute letters in a certain order.

Then you can click this icon if you want to preview the letter before you use it.

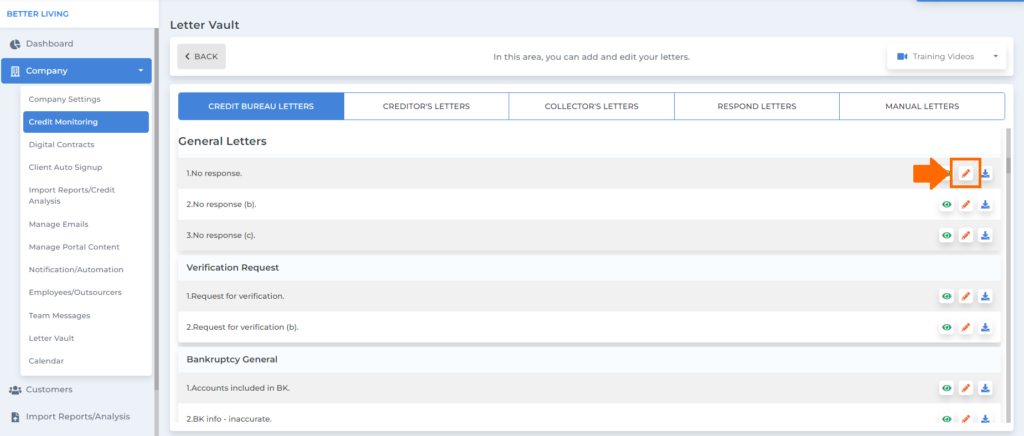

You can edit the default letters by clicking this icon.

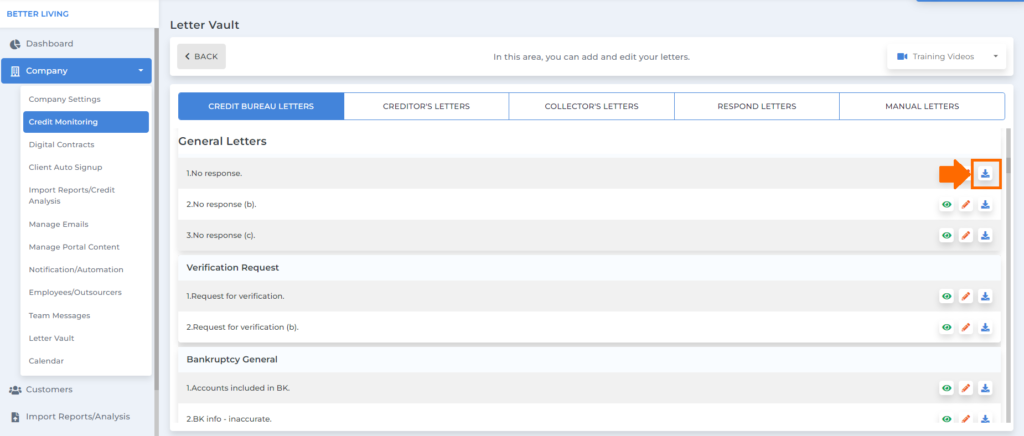

You can also download the letter by clicking this icon.

The credit bureau is a data gathering agency, and sometimes the information they provide might be inaccurate and affect the score of your customer. If you find this error, the best way to help your customer improve their credit standing is to write a dispute letter to the bureaus.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.