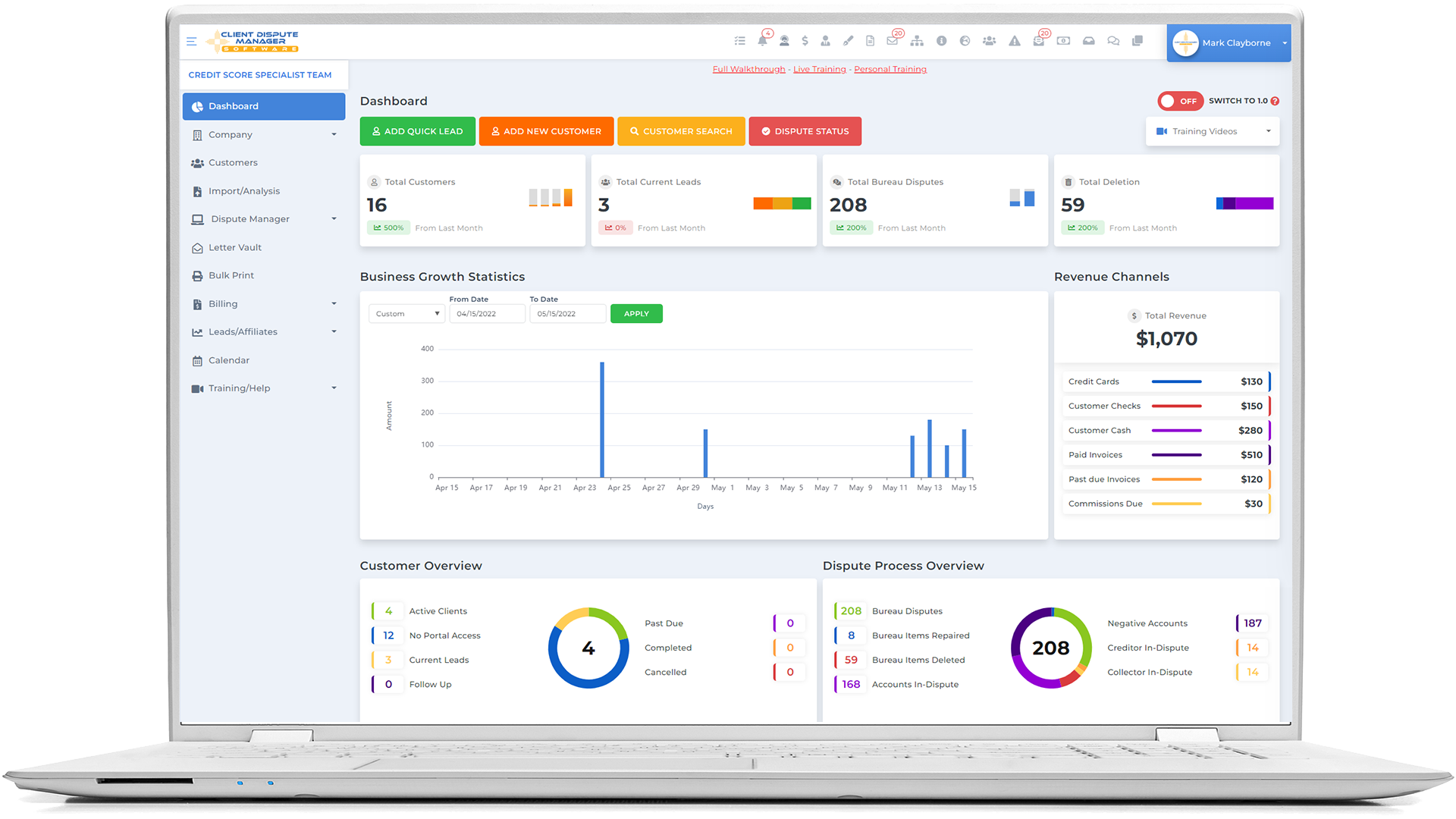

Anyone looking to repair their credit or operate a credit repair business should strongly consider using quality credit repair software. Specifically developed for this industry, this software offers a wide variety of features designed to be highly useful for both customers and credit repair businesses alike.

Let us go ahead and look at the ten reasons why you should seriously consider using a quality platform like the Client Dispute Manager Software.

Be your own boss. Set your own schedule and travel when you want. Start a credit business today. Click here to get everything you need for FREE.

1. Software Can Detect Inaccurate Information on Your Credit Report

Credit repair software can detect information on a credit report that is inaccurate. Why is this feature necessary? Because this is one of the easiest and fastest ways to improve a credit score, so it’s one of the first things that should be looked for.

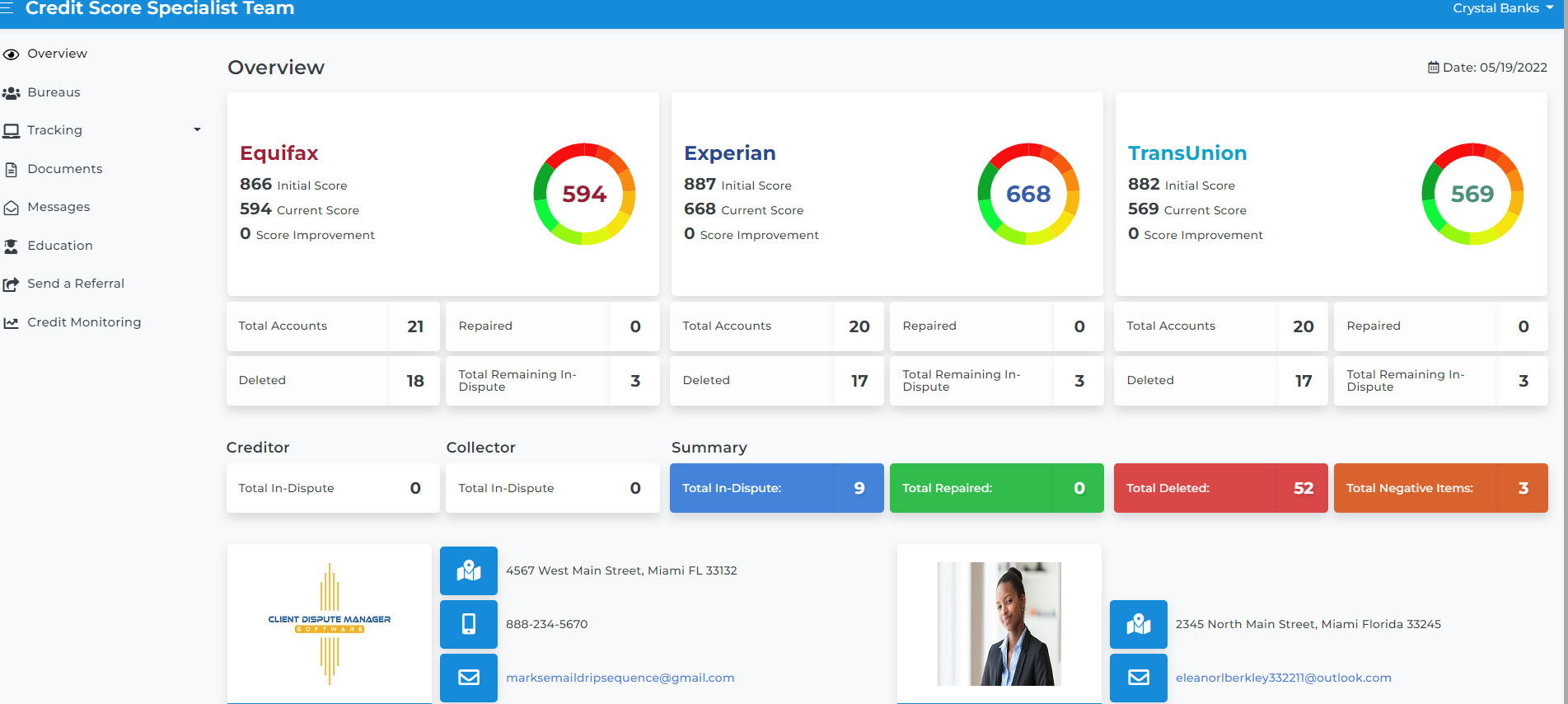

Amazingly, the software allows users to identify issues with the credit report more easily and begin the dispute process to remove those inaccurate negative items. This feature also looks for discrepancies between reports from the major credit bureaus, making finding items to dispute easier.

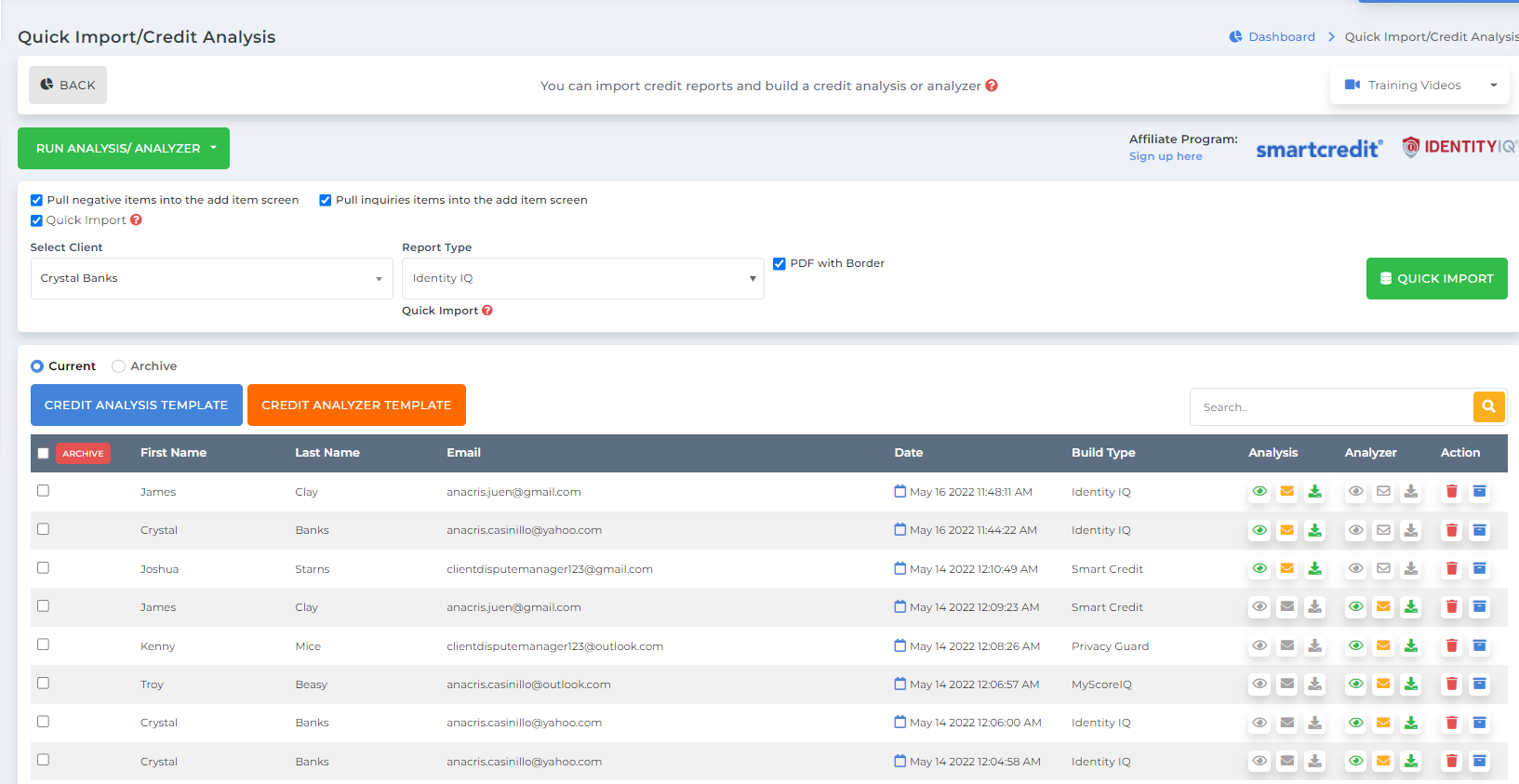

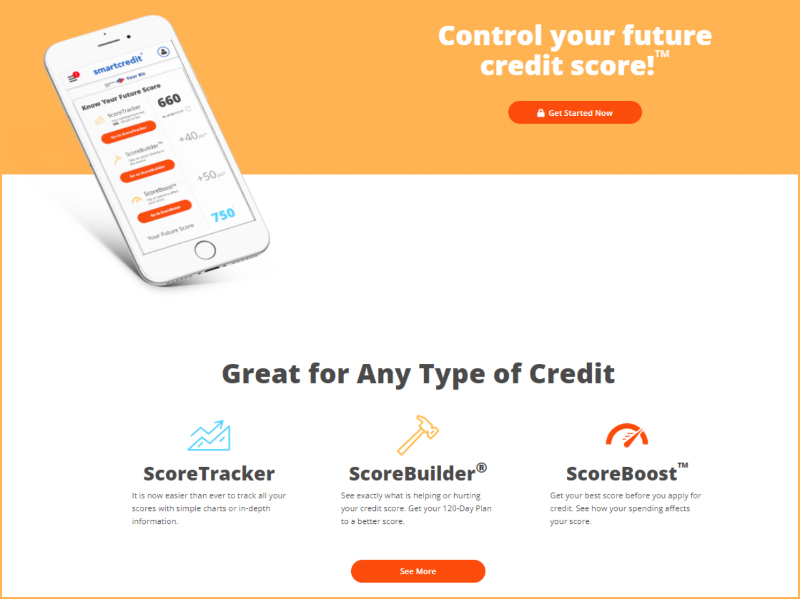

2. It Can Link Directly to Credit Monitoring Services

One of the biggest benefits of using dedicated software for the credit repair industry is that it can link to credit monitoring services to analyze reports across multiple agencies at once. This saves tremendous amount of time and makes it much easier to check for discrepancies.

Reports from the top credit monitoring companies are compatible with the CDM software and can be easily imported in less than a minute. When an item has been removed, the software will also highlight these for your reference.

3. It Offers Opportunity for Automation

Automation is incredibly useful in the credit repair industry because it helps everyone saves time and allows various tasks to be completed without you always being present.

The software can help you communicate with clients through text messages as well as provide automated updates regarding ongoing disputes in their client portal. It also provides the capacity to educate and nurture customers via scheduled e-mails about credit repair topics and good financial habits. This not only helps them repair their credit now but also helps them maintain good credit going forward.

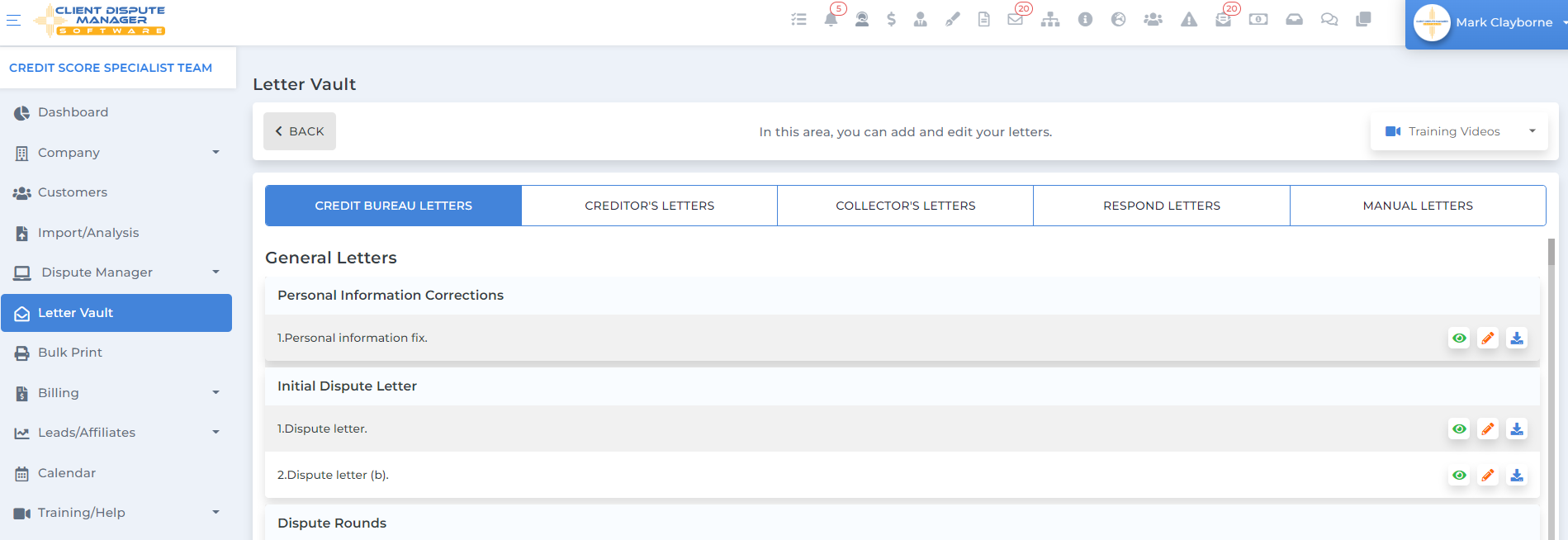

4. It Provides Templates

Credit repair software can provide letter and document templates that make it easier for users to take in clients as well as start the dispute process. With letter templates from the software, customers can easily raise disputes about incorrect financial information from their credit reports.

You can also upload and digitally sign contracts to quickly get those agreements into effect. All documents and templates are saved so they can be used again whenever needed and can even be customized.

Be your own boss. Set your own schedule and travel when you want. Start a credit business today. Click here to get everything you need for FREE.

5. It Keeps Your Clients Updated on Their Progress in Real-Time

Customers appreciate having access to their information because they can view their progress in real-time, and efficient credit repair software should be able to do this. In addition, the software can support automated updating of credit scores so customers can always see their credit rating at any given time.

Customers can even upload their documents to the software through the client portal so you can easily access them. Credit Repair Software also utilizes mobile apps where customers can view updates, information, and even send secure messages while on the go.

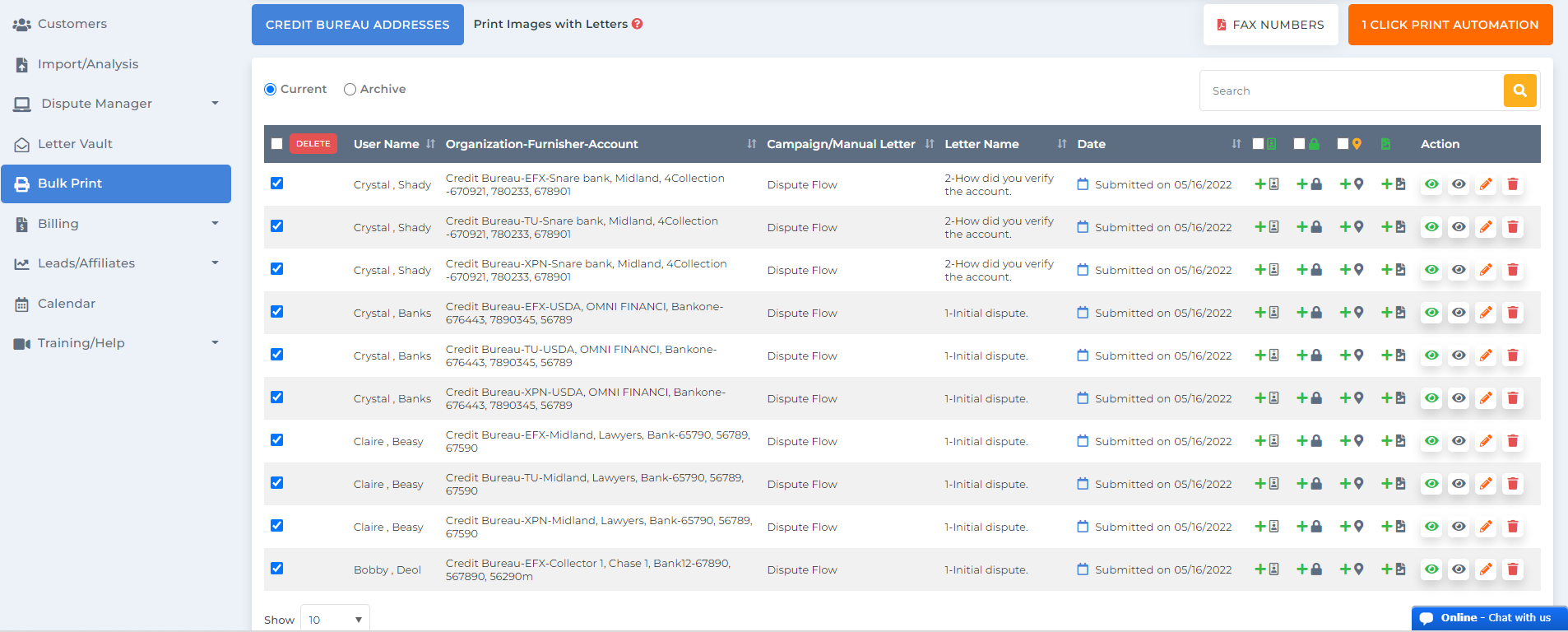

6. Disputes Can Be Raised Via Credit Repair Software

If inaccurate negative information or identity theft is discovered in a customer’s financial information, disputes can be raised directly through the credit repair software itself. It is then sent to the relevant parties, either electronically or through printed letters, so that the information can be checked and acted upon.

Our software even allows disputes to be made in bulk, which greatly speeds up the process. This allows for the faster removal of incorrect information from a customer’s credit report and an improved credit score with little effort.

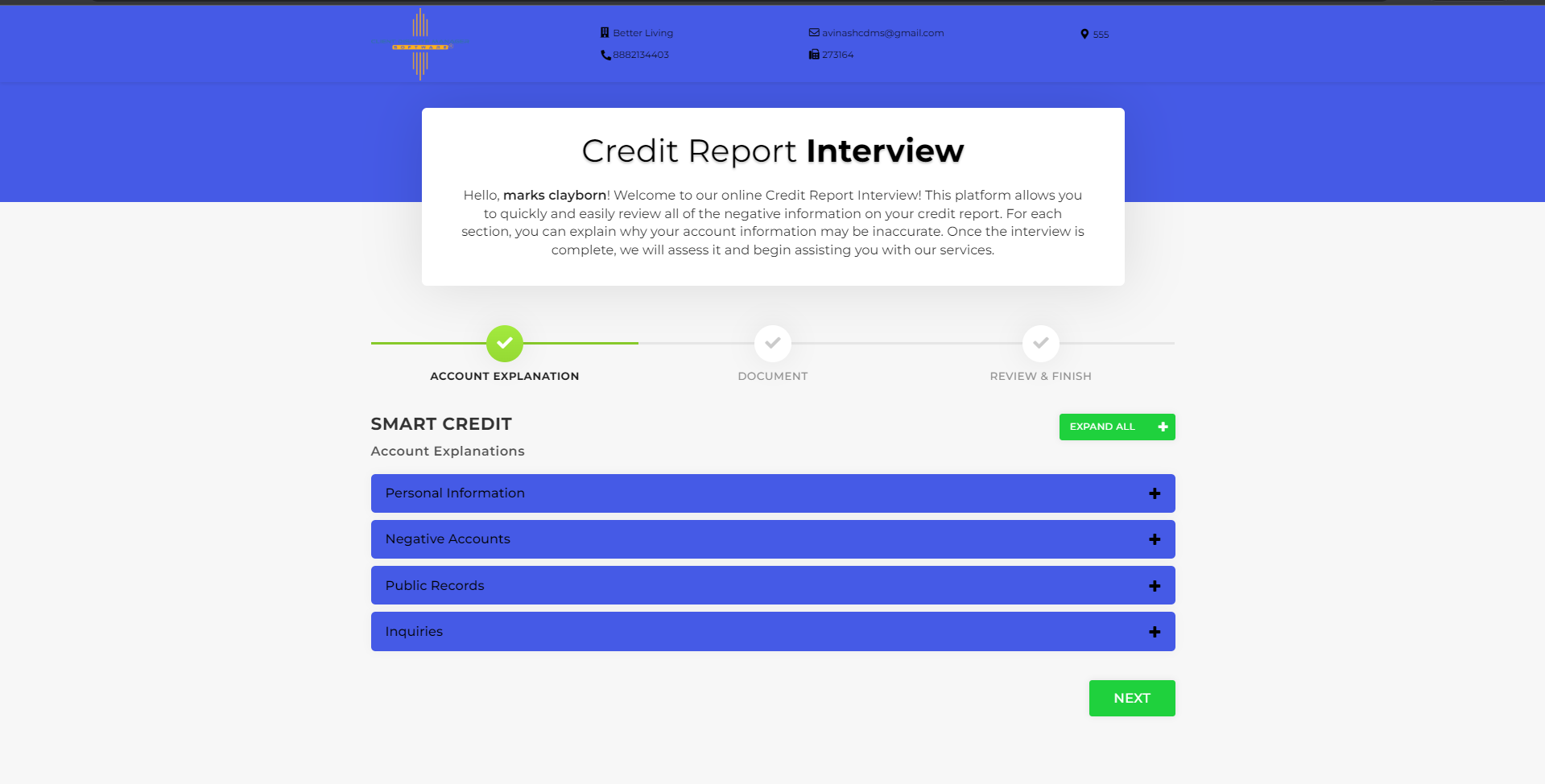

7. It Provides Automated Customer Interviews and Onboarding

If inaccurate negative information or identity theft is discovered in a customer’s financial information, disputes can be raised directly through the credit repair software itself. It is then sent to the relevant parties, either electronically or through printed letters, so that the information can be checked and acted upon.

Our software even allows disputes to be made in bulk, which greatly speeds up the process. This allows for the faster removal of incorrect information from a customer’s credit report and an improved credit score with little effort.

8. It Offers Marketing Opportunities

Marketing is one of the most important elements of running a small business, but it can be one of the most challenging ones. It is challenging in the credit repair business due to regulations in place to protect both customers and businesses.

You can use this software to generate affiliate referrals that can grow your business organically through dedicated partnerships. It also provides lead forms that can be integrated into your company’s website through which interested parties can contact you.

Be your own boss. Set your own schedule and travel when you want. Start a credit business today. Click here to get everything you need for FREE.

9. It Allows the Management of Employee Permissions

Not every employee should be privy to all information stored in a program or access all of its features. With the ability to manage employee permissions, you can allow access only when tasks demand.

The ability to manage employee permissions is vital because it boosts security as well and even helps you delegate your tasks conveniently. If you have any issues using these features, the software has robust support to help you ensure you can set it up how you need it to be.

10. It Offers Increased Security

The importance of security in the business of credit repair cannot be overstated because the industry constantly needs to handle sensitive personal financial information. The latest security features will protect quality credit repair software so both the business and the customer’s information will be well-protected.

In addition, cloud-based software offers the extra protection of having data stored offsite so none of your sensitive information will be threatened in the case of a break-in, fire, flood, or other disasters at a credit repair business’ physical office.

Conclusion

Credit repair software is a worthwhile investment whether you operate a credit repair business or want to improve your own credit. If you are unsure if it’s for you, you can try out a free trial and see all it has to offer. Businesses are likely to find that it makes their regular operations much smoother while customers are far more likely to see an efficient service while their credit scores are being restored.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that. Click here to learn more.