If you are in the credit repair industry, collecting documentation and proof of identification is essential on your credit repair business plan. This is because you will write dispute letters on your customers’ behalf.

It should be conceivable that your customer, not you, is the one who is sending the letter.

You and your customer can successfully challenge the negative accounts that shouldn’t be listed on their credit report by supplying supporting documentation.

There’s a feature in the startup credit repair business wherein you and your customer can upload/add documents that you can use in creating your disputes.

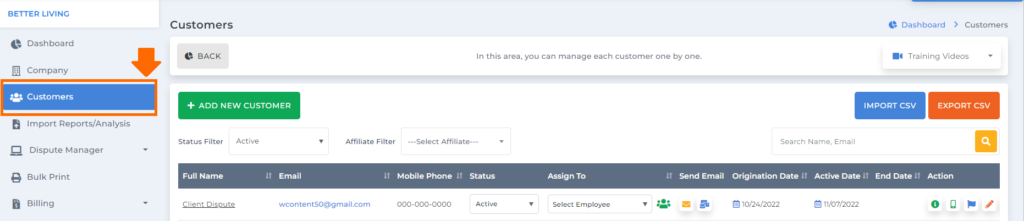

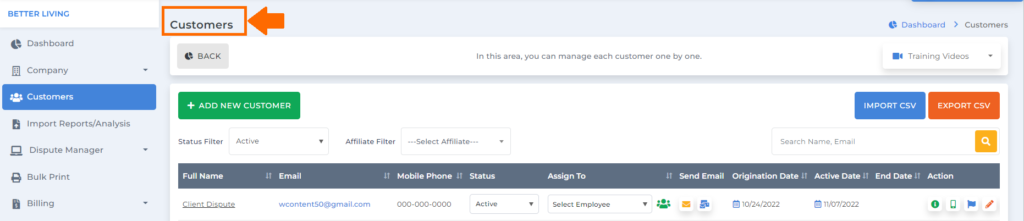

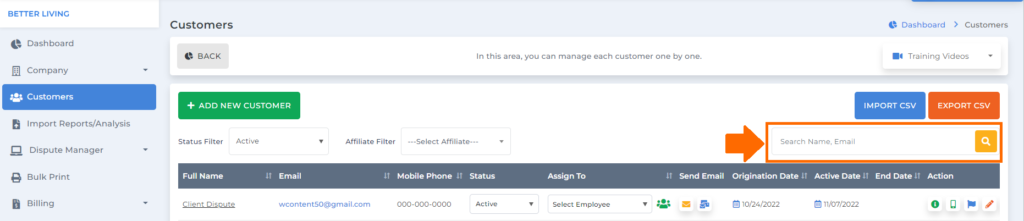

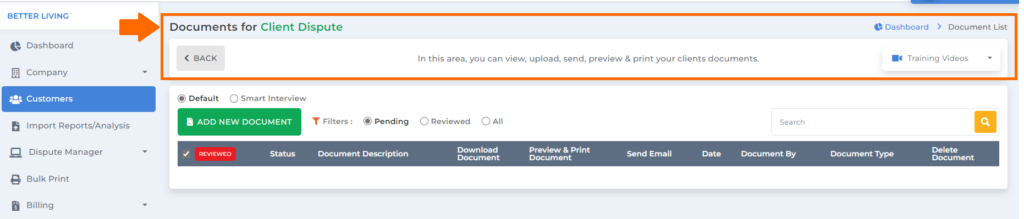

To access the document screen in the startup credit repair business, go to the dashboard and click customers.

Then you will be routed to the customers’ screen, where you can manage each customer.

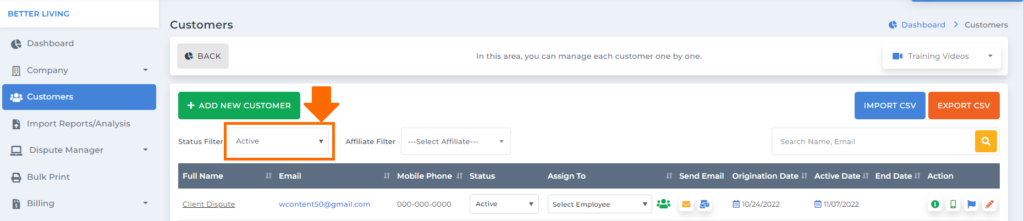

You can use the status filter anytime to look for customers with the same status.

There’s also a search box where you look for a specific customer.

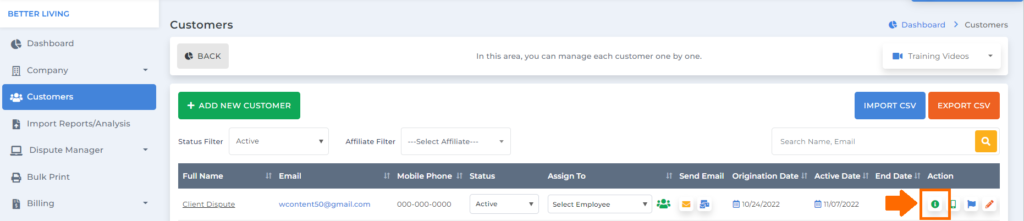

Once you have your customer information ready, go to the action column and click the customer information icon.

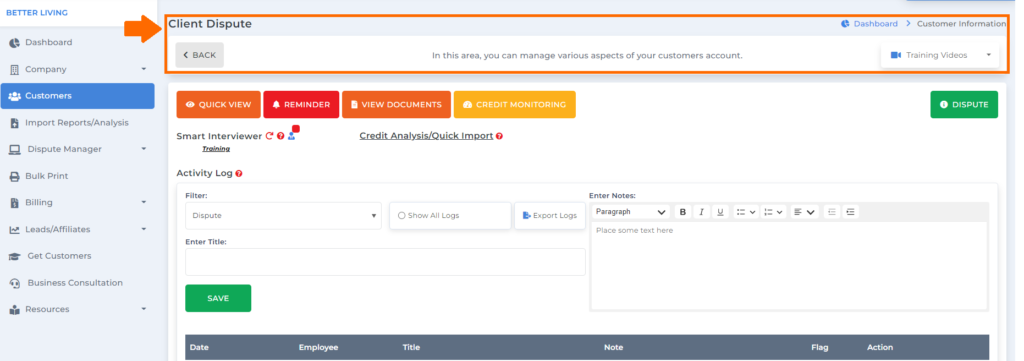

By clicking the Customers option, you will be able to manage various aspects of your customer’s account.

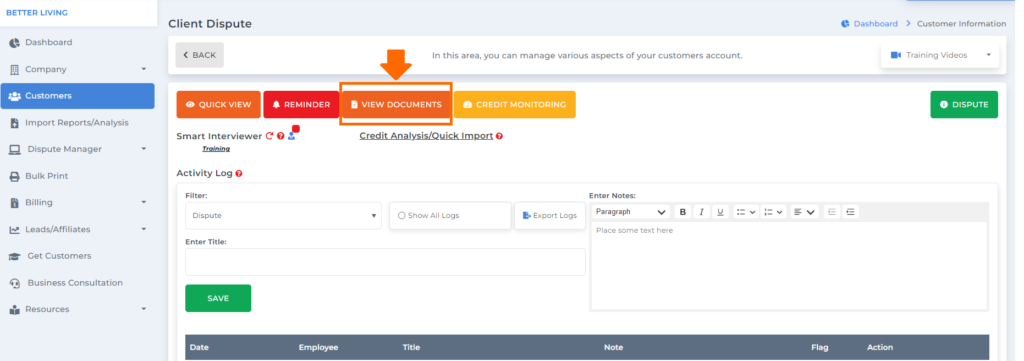

This is the view document button.

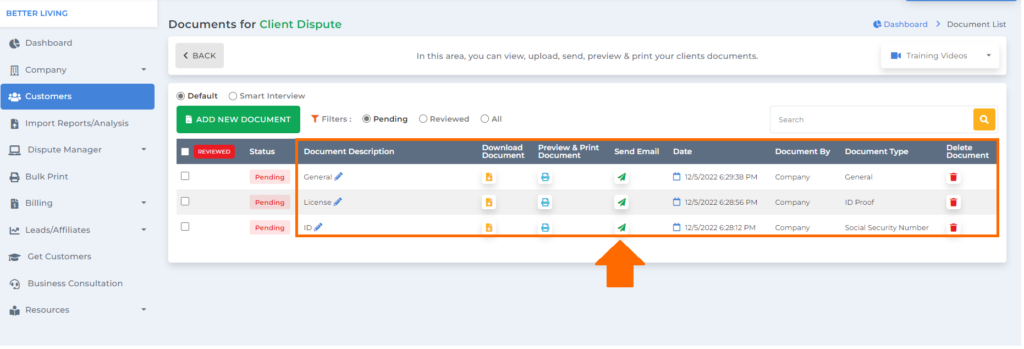

Once you click the view document, it will route you to the document section where you can view, send, preview, and print.

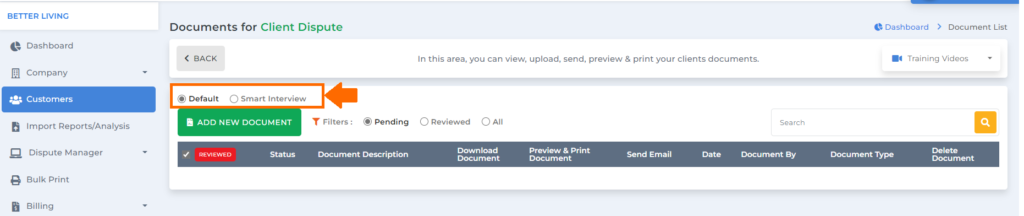

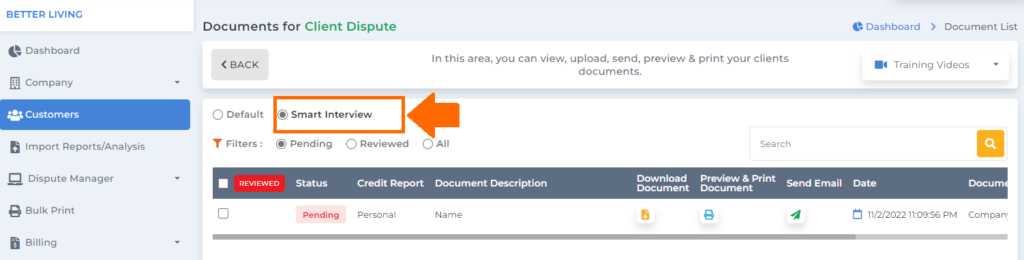

In this section, we have the default and smart interviewer.

The default documents are those from your customer when they go through the client auto signup or use their client tracking portal.

The smart interviewer documents are those from your customer when they went through the smart interviewer process.

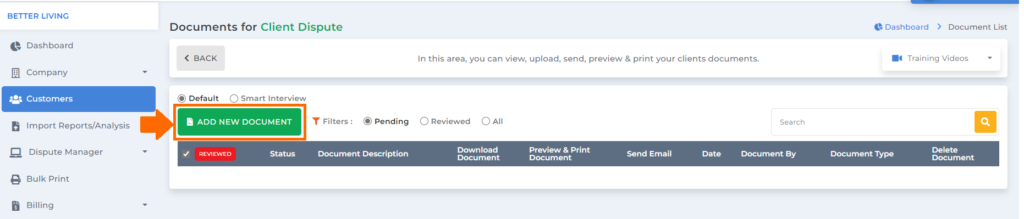

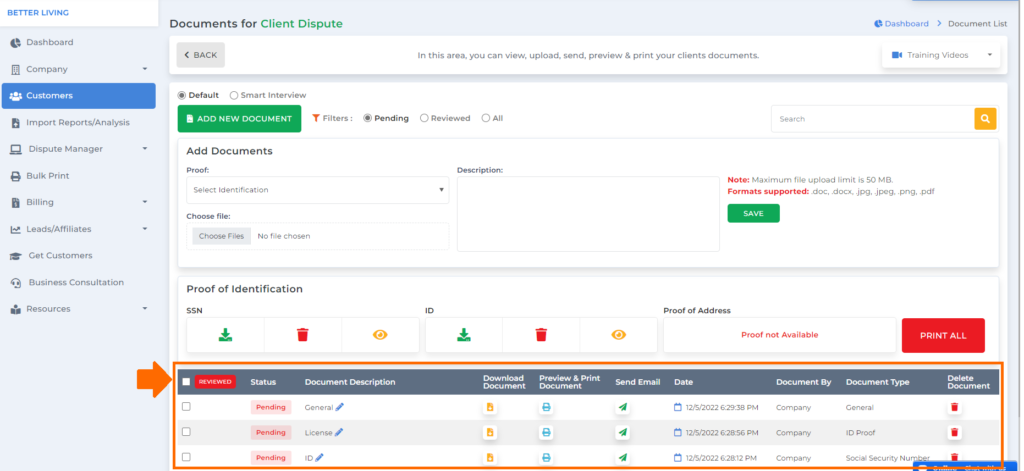

If you want to add a new document, click the “add new document” button.

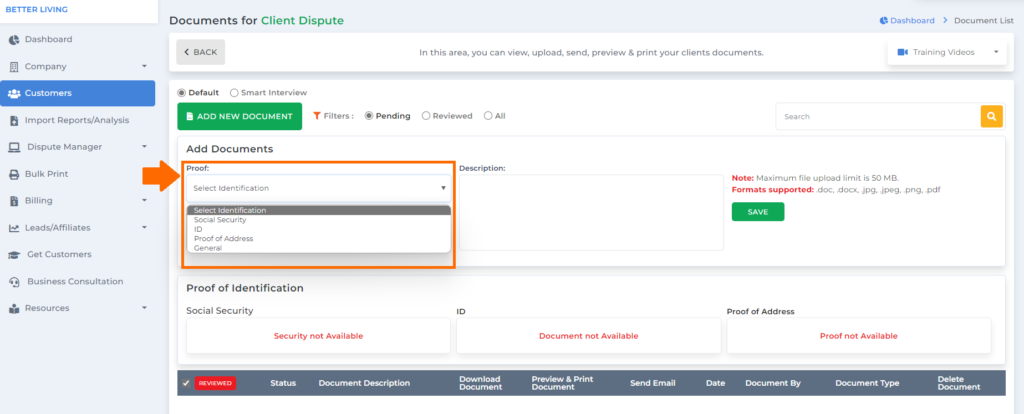

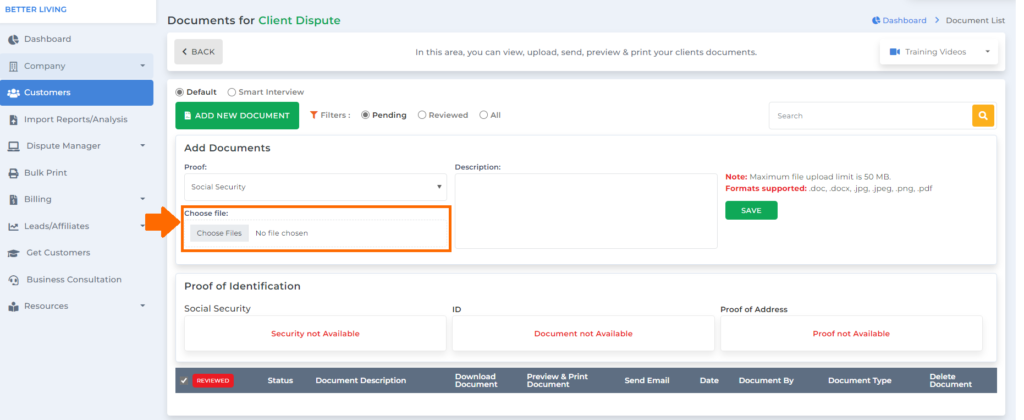

Then you need to select what type of document you will be uploading.

Once done, click choose file to upload the document.

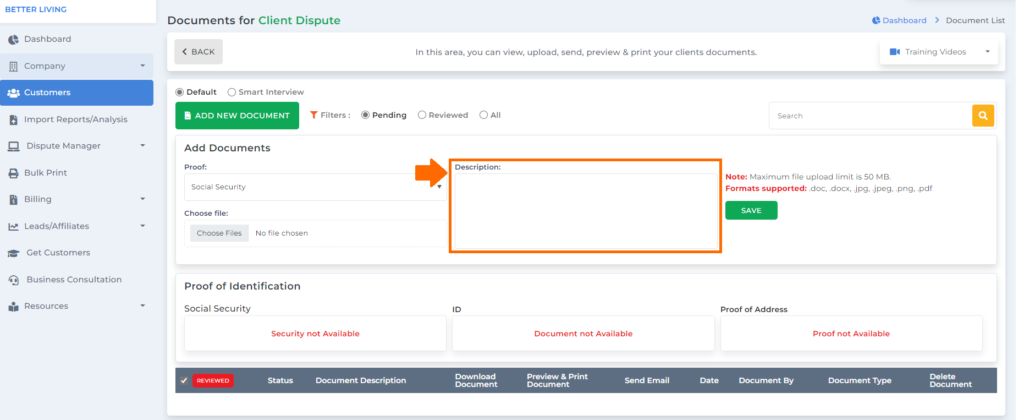

Inside the text box, put a description of the document.

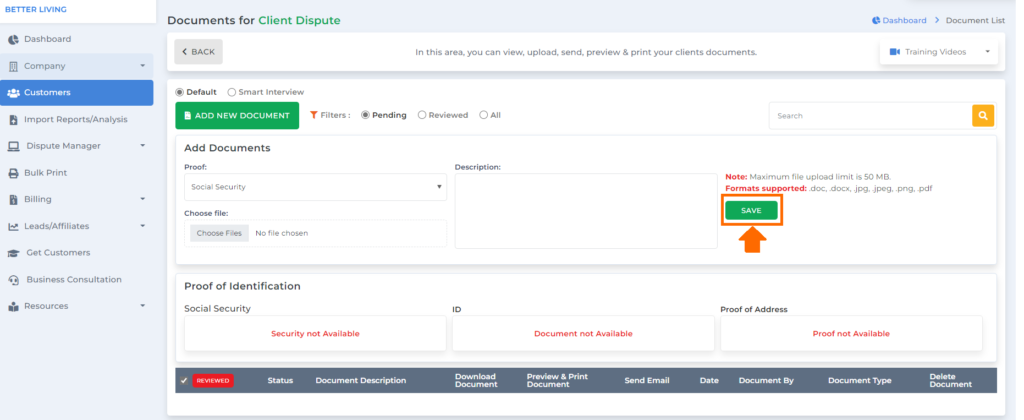

Then click save once you are done.

Note: Maximum file that you can upload is 50 MB, and the formats supported would be: .doc, .docx, .jpg, .jpeg, .png, and .pdf.

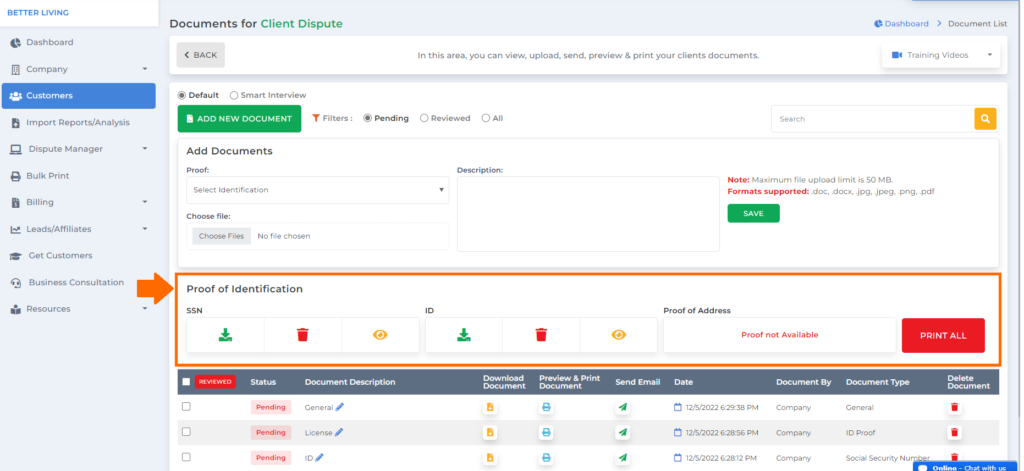

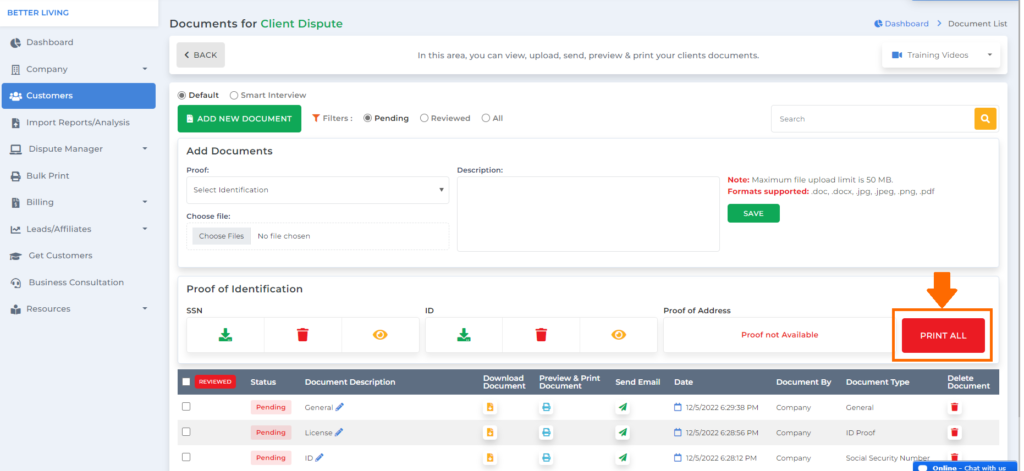

Once you upload the proof of identification, it will show in this section where you can print them all.

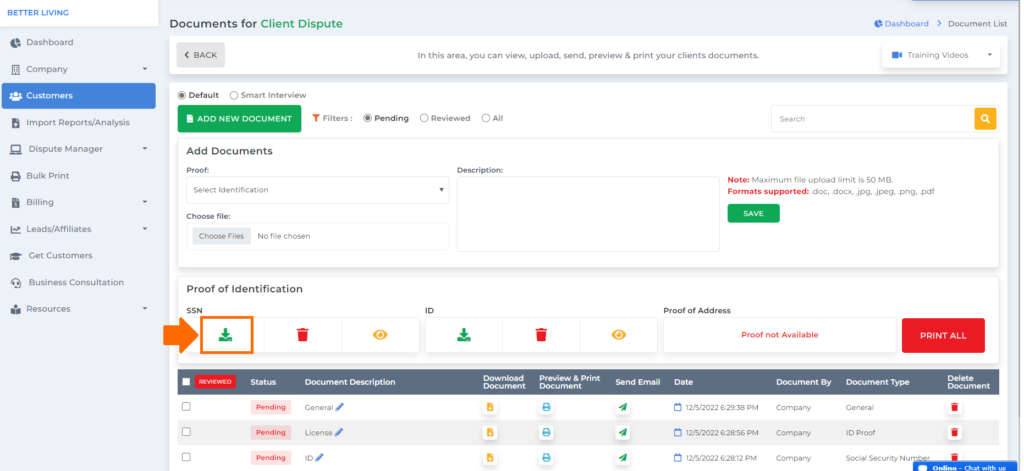

You can click this icon to download the proof of identification.

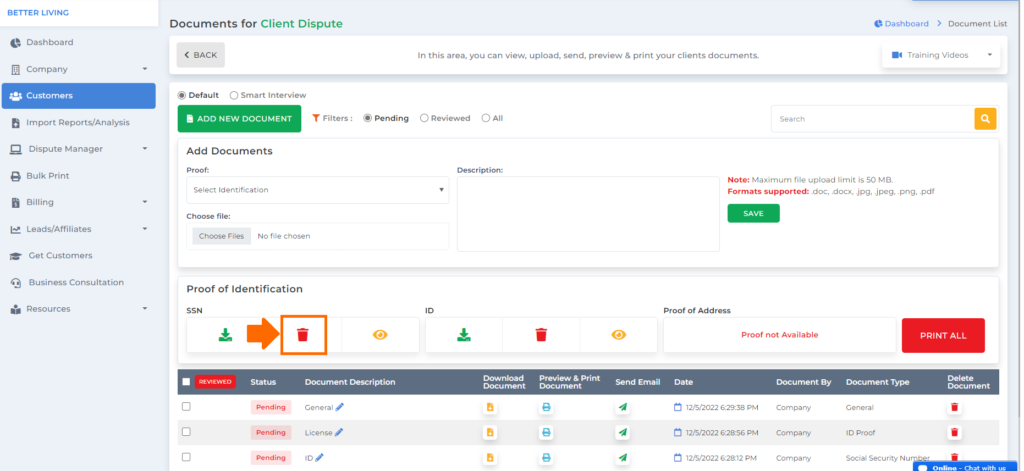

If you want to delete the proof of identification so you can upload a new one, click this delete icon.

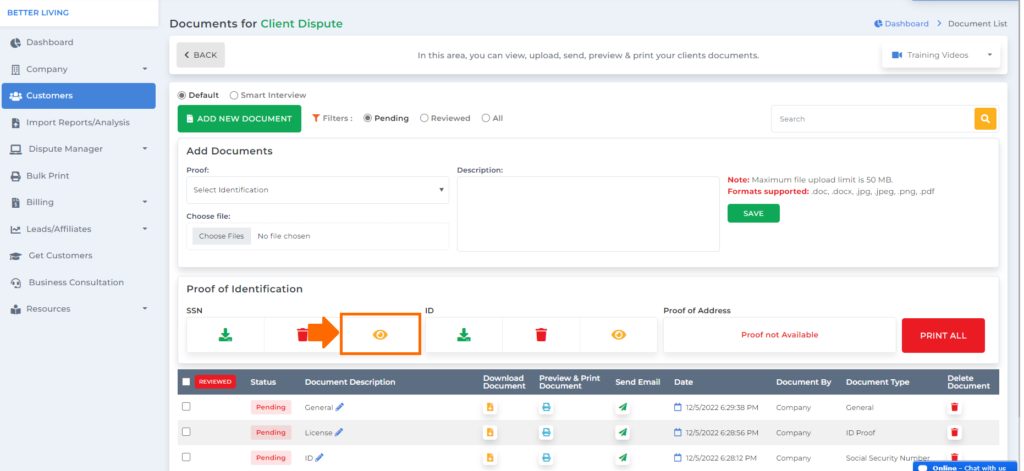

You may also preview the document by clicking the eye icon.

And if you wish to print all the proof of identification, just click the “print all” button.

In this table, you will see the proof of identification and other documents you and your customer uploaded.

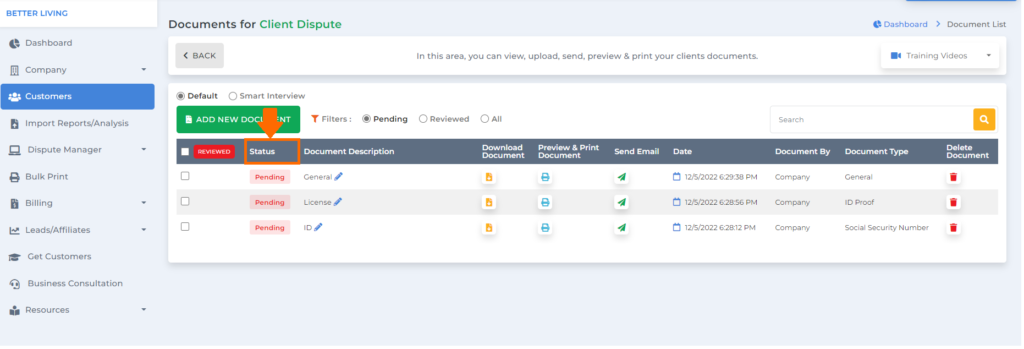

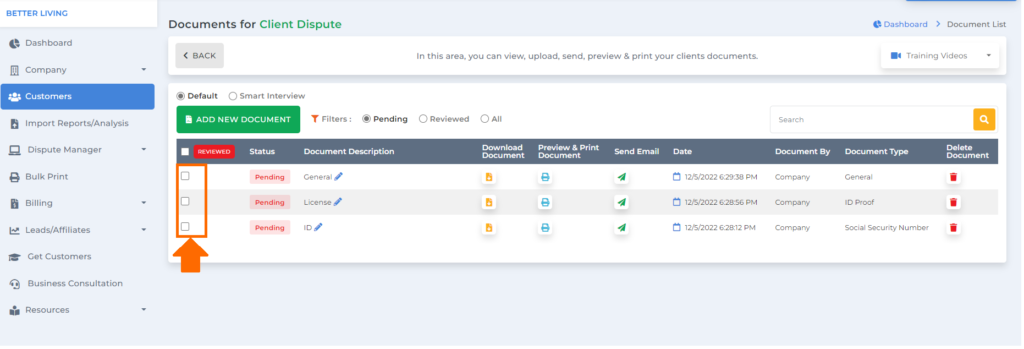

In this table, you will see the status column. If you or your customer just recently uploaded a photo, its status would be “pending.” That means you need to check the document first to see if it’s correct.

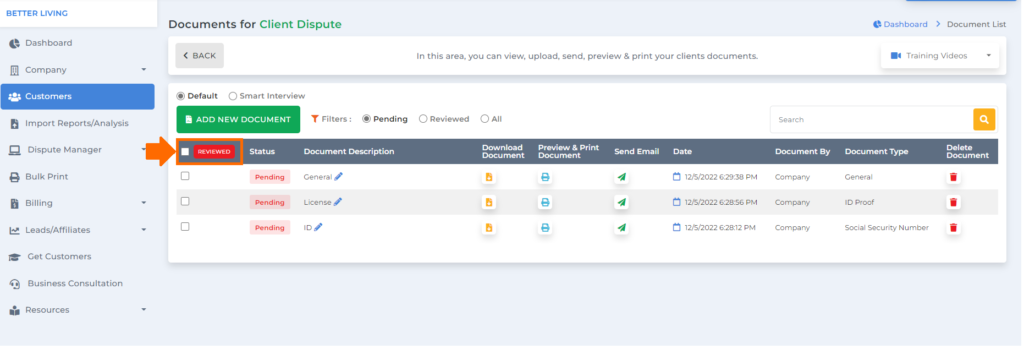

When you’ve finished reviewing the document and want to change its status, check the box over here.

Then click the “reviewed” button.

The remaining columns are information about the document.

You just need to check this section to see the documents your customers added when they went through the smart interviewer process.

Credit restoration is not easy. However, gathering information and supporting documents from your client will enable you to create a flawless dispute letter and assist them in repairing or raising their credit ratings.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.