In today’s digital landscape, credit repair professionals are increasingly turning to technology to streamline operations and boost their online presence. But what is the best credit repair software to elevate your business and establish your authority in the digital sphere? This comprehensive guide will explore how choosing the right credit repair platform can optimize your workflow and significantly enhance your digital footprint.

Start Today and Explore the Features Firsthand!

Role of the Best Credit Repair Software in Establishing Online Presence

Having robust credit repair software features is now a necessity for any serious player in the credit repair industry. Let’s delve into how the best credit repair software contributes to building your authority online:

Elevating Your Professional Image with Credit Repair Software Features

When you leverage top-tier credit repair software, you’re sending a powerful message to potential clients: you’re committed to excellence and willing to invest in the best tools available. This commitment to professionalism can significantly boost your credibility in the digital space.

Imagine a potential client comparing two credit repair businesses online. The first uses a sleek, professional client portal provided by their credit repair software, offering real-time updates and easy communication. The second relies on sporadic email updates and phone calls. It’s clear which business will make a stronger first impression and appear more trustworthy.

Mastering Client Management with the Best Credit Repair Software

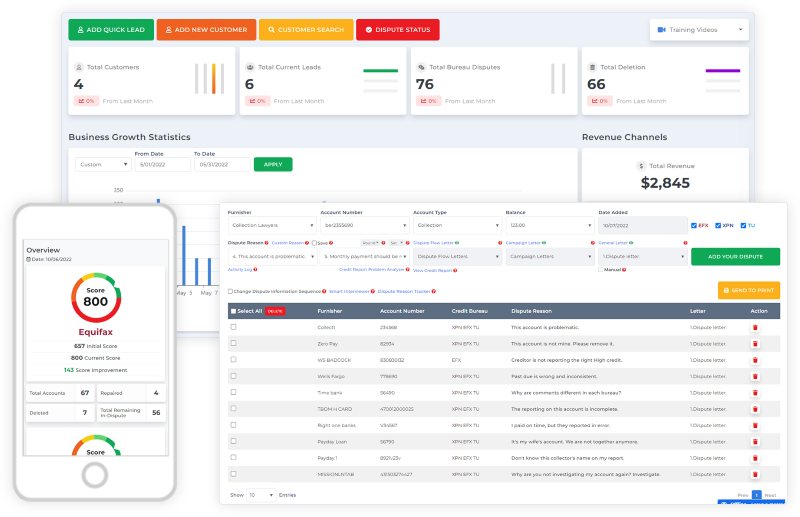

Efficient client management is the cornerstone of maintaining a stellar online reputation. The best credit repair software empowers you to organize client information seamlessly, track progress effortlessly, communicate promptly, and automate routine tasks. These credit repair software features lead to satisfied clients who are more likely to leave positive reviews and testimonials, further bolstering your online authority.

Harnessing the Power of Data with Credit Repair Software Features

Many advanced credit repair platforms offer robust reporting and analytics features. By leveraging these tools, you can share data-driven insights on your website or social media, positioning yourself as an informed expert in the field and enhancing your digital presence.

Start Today and Explore the Features Firsthand!

Navigating the Credit Repair Software Evaluation Process: Choosing the Right Platform

Selecting the best credit repair software is a critical decision that can shape the future of your business. Let’s walk through a comprehensive credit repair software evaluation process to help you make an informed decision.

Understanding Your Unique Business Needs in Credit Repair Software Comparison

Before diving into credit repair software options, it’s crucial to understand your specific business requirements. Consider your current client base, growth projections, and essential features for your day-to-day operations. Remember, the best credit repair software for a solo practitioner will likely differ from the ideal solution for a larger firm.

Your chosen software should meet your current needs and have the scalability to support your future growth plans.

Dissecting Key Features in Your Credit Repair Software Evaluation

When conducting a credit repair software comparison, focus on features that will truly impact your business. Pay close attention to dispute automation capabilities, credit report analysis tools, client portals, secure document storage, customizable templates, and integration capabilities.

As you evaluate these features, create a prioritized list based on their importance to your business. This will help you focus on what truly matters during your credit repair software evaluation.

Leveraging the Best Credit Repair Software to Amplify Your Online Authority

Now that we’ve explored how to choose the best credit repair software, let’s discuss how you can leverage its features to enhance your digital presence and establish yourself as an authority in the field.

Crafting Compelling Success Stories with Credit Repair Software Features

One of the most powerful ways to boost your online authority is by sharing client success stories. The best credit repair software makes it easy to track client progress and outcomes. Use this data to create engaging case studies that showcase your expertise and results. Consider creating a monthly “Client Spotlight” feature, using concrete data to illustrate credit score improvements and items removed from credit reports.

Creating Educational Content Using Credit Repair Software Insights

Many credit repair software platforms come equipped with a wealth of educational resources. Use this information to create valuable content for your audience, positioning yourself as a knowledgeable authority in the field. Develop blog posts or videos explaining different aspects of credit repair, using insights from your software to provide real-world examples.

Start Today and Explore the Features Firsthand!

Leveraging Automated Updates for Enhanced Client Satisfaction

Some of the best credit repair software options allow you to automatically share progress updates with clients. By keeping clients consistently informed, you’re more likely to receive positive reviews, which can significantly boost your online reputation. Set up automated milestone notifications and encourage satisfied clients to share their experiences online.

Integrating with Marketing Tools for Targeted Outreach

Look for credit repair software that integrates seamlessly with marketing platforms. This integration allows you to create highly targeted campaigns, further expanding your digital reach. For example, you could integrate your credit repair software with an email marketing tool to send personalized content based on a client’s specific credit issues or progress.

By fully leveraging these credit repair software features, you can significantly enhance your online authority, establishing your expertise and growing your digital presence in the credit repair industry.

Client Dispute Manager Software: A Crucial Component of the Best Credit Repair Software

When choosing a credit repair platform, one feature that deserves special attention is the Client Dispute Manager. This powerful tool is often a cornerstone of the best credit repair software, streamlining one of the most critical aspects of credit repair: managing and tracking client disputes.

A robust Client Dispute Manager automates and organizes the entire dispute process, allowing you to easily create, send, and track dispute letters for each client. The best credit repair software will include customizable templates for dispute letters, ensuring compliance with current regulations while allowing personalization for each client’s unique situation.

Look for a Client Dispute Manager that provides detailed tracking of each dispute’s progress and integrates seamlessly with other software features. This integration enhances the overall efficiency of your credit repair process and provides valuable data for your ongoing credit repair software evaluation.

Start Today and Explore the Features Firsthand!

Prioritizing User Experience in Choosing a Credit Repair Platform

A user-friendly interface is paramount, both for you and your clients. During your credit repair software evaluation, pay close attention to the ease of navigation, mobile responsiveness, and the learning curve for you and your team. Take the time to navigate through demo versions of the software you’re considering. Remember, the best credit repair software should enhance your efficiency, not create new hurdles.

Building a Comprehensive Online Presence: Beyond Credit Repair Software

While the best credit repair software is undoubtedly a powerful tool, it’s just one piece of the puzzle when it comes to building a strong online presence. To truly establish yourself as an authority in the credit repair industry, consider implementing these additional strategies:

- Develop a robust content marketing strategy

- Engage actively on social media platforms

- Optimize your website for search engines

- Participate in industry forums and discussions

- Collaborate with other financial experts for guest posting opportunities

The Transformative Impact of the Best Credit Repair Software on Business Growth

Implementing the best credit repair software can have a profound effect on your business, extending far beyond mere efficiency gains. Here’s how the right software can catalyze growth and success in your credit repair business:

- Increased efficiency through automation

- Reduced likelihood of human error

- Enhanced professionalism and client perception

- Improved scalability as your business grows

- Better compliance with industry regulations

Conclusion

In conclusion, choosing the best credit repair software is a crucial step in building your online authority and enhancing your digital presence. By carefully evaluating your options, leveraging key credit repair software features, and combining software use with broader digital marketing strategies, you can establish yourself as a leader in the credit repair industry.

Remember, the right tools, coupled with your expertise and dedication, can open doors to unprecedented growth and success in the digital landscape. As you embark on your journey to find the perfect credit repair software, keep in mind that this decision can significantly impact your business’s efficiency, scalability, and overall success.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: