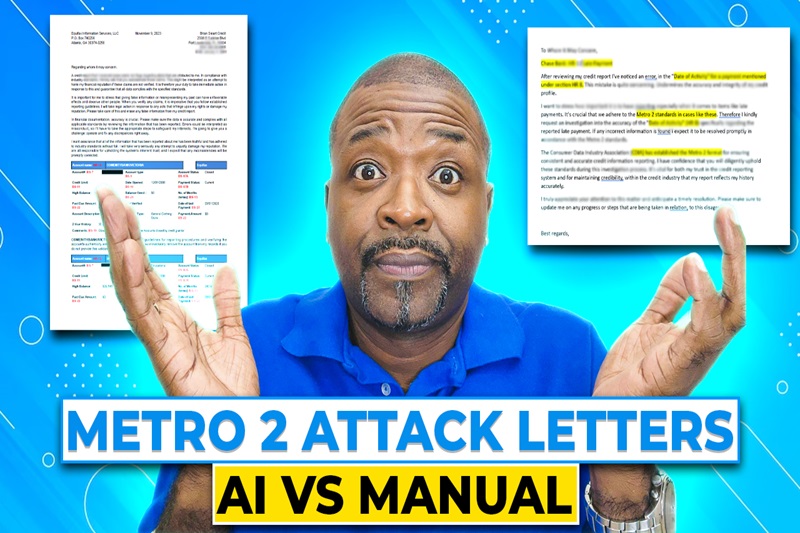

In the realm of credit disputes, understanding and leveraging the Metro 2 format can significantly enhance the effectiveness of your disputes with credit bureaus. This article delves into the distinctions between manually creating Metro 2 attack letters and utilizing an AI-driven OneClick Metro 2 Attack Engine to streamline this process. Plus, discover how to access a free 30-day trial of the Client Dispute Manager software to kickstart your journey.

Start Today and Explore the Features Firsthand!

Deep Dive into Metro 2

At its core, Metro 2 is a language developed for the specific purpose of facilitating communication between credit bureaus and furnishers concerning consumer credit information, using the Automated Consumer Dispute Verification (ACDV) form.

This standardized format ensures that all parties involved in the credit reporting process speak a common language, thereby reducing errors and misunderstandings.

Metro 2 Attack Letters: A Strategic Tool in Credit Repair

A Metro 2 attack letter is not just any letter; it is a meticulously crafted document that incorporates Metro 2 codes to articulate disputes with precision. This advanced approach is predicated on the belief that using the same language as credit bureaus can potentially increase the likelihood of a successful dispute resolution.

Understanding the strategic value of these letters is pivotal for individuals navigating the complexities of credit repair.

Manual Creation vs. AI-Enhanced Metro 2 Letters

Creating a Metro 2 letter from the ground up is a daunting task. It necessitates a granular understanding of the 2020 Credit Reporting Resource Guide, a document that, while exhaustive, is not designed with the average consumer in mind.

This is where technology comes to the rescue. The Client Dispute Manager software, with its OneClick Metro 2 Attack Engine, simplifies this intricate process, enabling users to generate precise, effective Metro 2 letters in seconds.

Transforming Credit Dispute Resolution with AI

The advent of AI technology in the realm of credit dispute resolution marks a significant leap forward. The Client Dispute Manager Software exemplifies this technological advancement by offering an efficient, automated solution for generating Metro 2 attack letters.

This not only saves invaluable time but also ensures that each communication is unique and specifically tailored to the individual’s dispute, thus amplifying its effectiveness.

Start Today and Explore the Features Firsthand!

Leveraging the Client Dispute Manager: Your Path to Empowerment

Embarking on the journey to correct your credit report is now more accessible than ever, thanks to the free 30-day trial offered by the Client Dispute Manager. This trial provides a glimpse into the software’s robust capabilities, including the generation of AI-powered attack letters.

To continue leveraging the full spectrum of features, including the Metro 2 letter generator, users are encouraged to consider upgrading to the paid plan at a specially discounted rate.

The Impact of Metro 2 Proficiency on Credit Repair Success

Understanding and utilizing the Metro 2 format is not just about disputing inaccuracies; it’s about doing so with a level of precision and understanding that aligns with the credit bureaus’ own processes.

This alignment can significantly enhance the efficacy of your disputes, potentially leading to quicker and more favorable resolutions. By employing tools like the Client Dispute Manager, consumers can navigate the credit repair process with greater confidence and sophistication.

The Future of Credit Disputes: Automation and Personalization

As we look to the future, it’s clear that the intersection of technology and personal finance will continue to evolve. The capabilities of AI in personalizing and automating the creation of Metro 2 attack letters are just the beginning.

This evolution promises not only to streamline credit repair efforts but also to empower consumers with tools and knowledge previously accessible only to industry professionals.

Conclusion

The contrast between manually creating Metro 2 letters and utilizing an AI-driven approach underscores a broader trend in financial technologies: the move towards making complex processes more accessible and user-friendly. For those embarking on the credit repair journey, understanding the strategic importance of Metro 2 and embracing the technologies designed to navigate it effectively are key steps toward achieving financial wellness.